Which mid-sized accounting firm gained the most new clients last year?

Our annual report of 2019 SEDAR filing data crunched by Audit Analytics

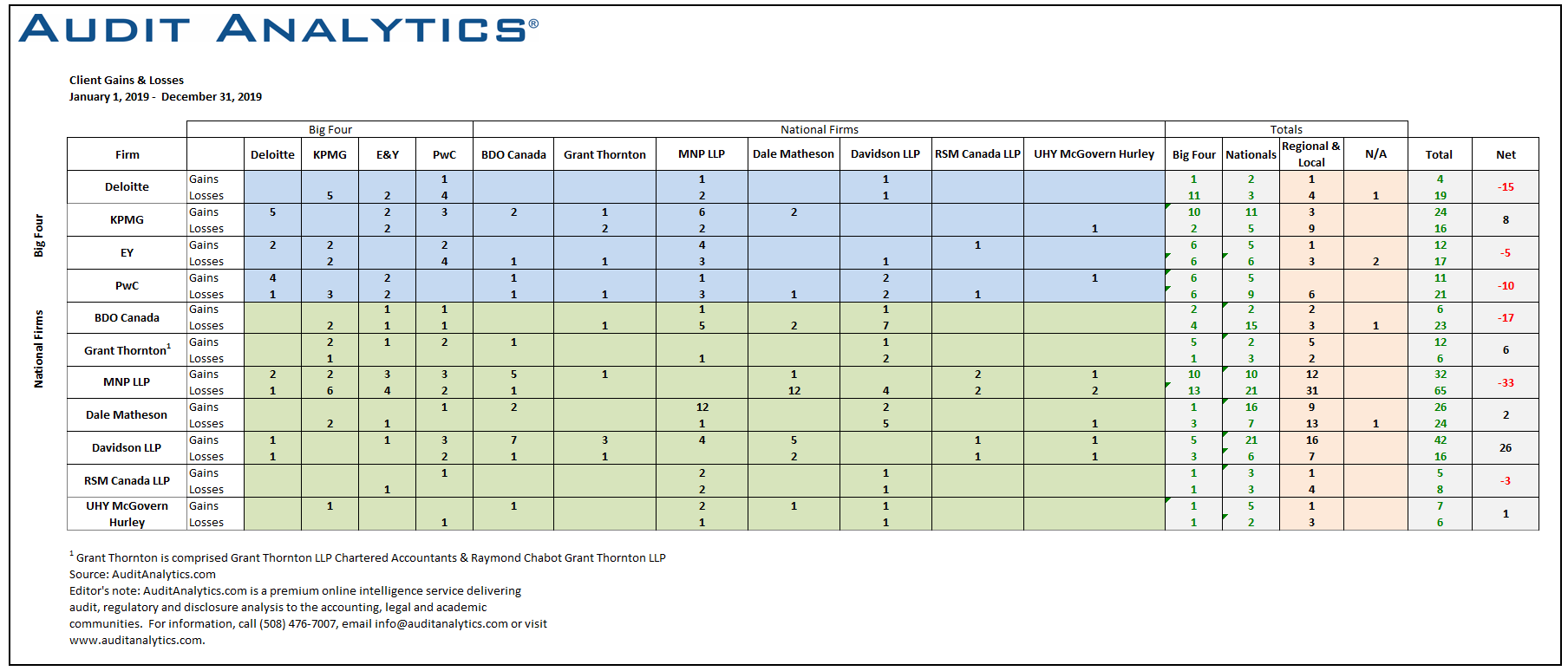

TORONTO, March 25, 2019 – Davidson & Company LLP, an accounting firm based in Vancouver, B.C., posted 42 new (public company) audit clients in 2019, according to SEDAR analysis provided to Canadian Accountant by Audit Analytics, an independent research provider based in the United States. The firm’s additions far surpassed all mid-sized accounting firms in net audit clients gains at 26, most of which are listed on the TSX Venture Exchange (TSXV).

The self-described “big enough to know, yet small enough to care” full-service professional accounting firm managed to add a number of former small cap clients of Big Four and national firms, totalling just over $1 billion in market capitalization in 2019. Davidson & Company also placed third among all firms, including the Big Four, in total audit fees of new clients, coming in at $3.1 million. The firm continued its 2018 streak, which saw Davidson & Company jump to sixth place in total market cap of new clients, based largely on its roster of resource companies, led by Fortem Resources.

2020 marks the fourth consecutive year that Audit Analytics has provided its annual data analysis of auditor changes among public companies in Canada exclusively to Canadian Accountant prior to publication. This year, we have separated our reports into Big Four clients gains and losses ("KPMG Canada leads Big Four in audit client gains, losses" published on March 20), this report on the mid-tier market, and a subsequent analysis of overall trends.

As from the chart below, just five audit firms posted a net gain of public company new clients in 2019. They were, in order of most to least: 1, Davidson & Company (26); 2, KPMG Canada, (8); 3, Grant Thornton, 6; 4, DMCL (2); and UHY McGovern Hurley (1).

|

|

Source: Audit Analytics. |

National Firms Pull In New Clients

National accounting firm Grant Thornton posted 12 new clients for a net gain of six, the most noteworthy being Mene Inc., a unique jewelry company that sells its products online, which boosted the overall market cap of Grant Thornton’s new clients to $346 million.

Homegrown Canadian accounting firm MNP LLP racked up 32 new audit clients in 2019. The Calgary-based national firm also surpassed the $1 billion market cap mark and added $2.2 million in new audit fees, good for fourth place overall among all accounting firms (including the Big Four), in 2019.

DMCL Chartered Professional Accountants, another mid-sized accounting firm based in Vancouver, added 26 new audit clients in 2019, with a net gain of two public companies. The majority trade on the TSX Venture Exchange or the Canadian National Stock Exchange (CNSX), although one, Hut 8 Mining Corp. (formerly Oriana Resources Corporation), trades on the Toronto Stock Exchange, with a market cap of $137 million (the largest of DMCL’s new clients).

Notable Mentions

Canadian Accountant’s deep dive into the Audit Analytics data provided a few notable mentions. For example, 10 firms out of more than 50 with new audit client gains, posted new audit revenue of more than $1 million. These included such mid-sized firms as Marcum LLP, Smythe LLP, and PFC Accounting Chartered Professional Accountants. Three of Marcum’s five new clients were cannabis companies.

Two Canadian accounting firms, Smythe LLP and PFC Accounting Chartered Professional Accountants, made almost the same in new audit fees in total: $1.09 million and $1.07 million respectively. Smythe did it by adding 10 new public company engagements. PFC did it by adding one: Curaleaf Holdings, a cannabis company. Curaleaf’s market cap in 2019 was $111 million, more than double the size of Smythe’s 10 companies.

And Macias Gini & O'Connell LLP (MGO), which is based in Sacramento, snapped up Green Thumb Industries, which trades on the CNSX and has a market cap of $2.4 billion. Smythe LLP added 10 engagements that brought in over $1 million in new audit fees on a combined market cap of $51.8 million.

Read our Big Four report, "KPMG Canada leads Big Four in audit client gains, losses," published on March 20).

2019 Client Gains and Losses are provided by Audit Analytics, which provides insight into the Canadian audit marketplace through market intelligence, due diligence, compliance monitoring and trend analysis. Its Canadian databases provide detailed research and expert analysis on nearly 4,000 companies filing with SEDAR. Contact them through 508 476.7007 or info@auditanalytics.com.

Colin Ellis is a contributing editor to Canadian Accountant.

(0) Comments