Paradise Papers tax leak will further damage credibility of Trudeau, Morneau

Massive leak reveals tax avoidance schemes in upper echelon of Canadian politics

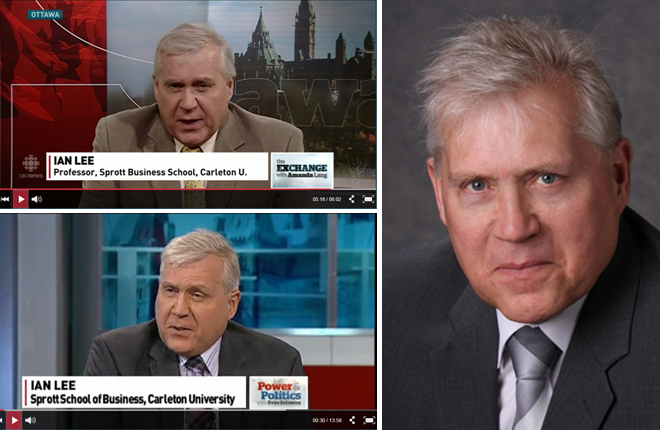

TORONTO, Nov. 6, 2017 – News that Canadian individuals and companies are disproportionately represented in leaked documents dubbed the “Paradise Papers” will further damage the credibility of the Trudeau government on tax reform. Among the names identified are three former Prime Ministers and the chief moneyman of Prime Minister Justin Trudeau.

Dubbed the “Paradise Papers,” 13.4 million documents from two offshore service providers and 19 tax haven company registries were hacked and then published by the International Consortium of Investigative Journalists (ICIJ), which also published the Panama Papers in April 2016. There are 3,300 Canadian individuals and companies named in the documents, behind only those from the U.S., U.K. and China.

Bermuda-based Appleby LLC, one of the largest offshore tax law firms in the world, admitted on October 25, 2017, that it suffered a “security incident” in 2016. Among the high-profile names listed in the Paradise Papers are Queen Elizabeth II, U.S. Secretary of Commerce Wilbur Ross, and Stephen Bronfman, heir to the Seagram fortune, chief fundraiser and senior advisor to Prime Minister Trudeau.

The Trudeau government is likely to face increased scrutiny over its commitment to tax reform. The Prime Minister campaigned on “Real Change,” and “tax fairness,” addressing income inequality, and reversing the decline of middle class incomes. However, since its election, the government has faced a number of high-profile setbacks and embarrassments all related to tax avoidance.

Shortly after being swept to power in October 2015, the Liberal government faced pressure from the Panama Papers leak of Panama-based Mossack Fonseca, followed by high-profile hearings related to the the Canadian clients of KPMG and tax avoidance schemes in the Isle of Man.

The government chose to embark on a tax reform campaign to close tax loopholes related to incorporation. That campaign ended in failure when it was revealed that its chief architect, Finance Minister Bill Morneau, had failed to place his family assets in a blind trust, as he had promised, and instead had structured in family fortune in two numbered companies.

News that one of Trudeau’s closest advisors has used offshore tax shelters has become international news and will further damage the government’s credibility on taxation. During the campaign against the Morneau proposals, the Opposition successfully questioned why the government was concentrating its reforms on smal business entrepreneurs, rather than tax avoidance by corporations and high net worth individuals.

According to the ICIJ, offshore tax schemes are used primarily by the "ultra rich," those with assets of $45 million or more, who are "ten times more likely to evade taxes than the average citizen."

As reported by the CBC and Toronto Star, Canadian corporate law firm Davies Ward, which includes Bronfman as a client, was a “leading player” in a campaign that delayed by 14 years legislation that sought to close offshore tax avoidance loopholes. That campaign included hearings into the legislation held in 2008 by the Liberal-dominated Senate.

Publication of the Panama Papers suggests that there will be more revelations to come as the journalists continue to sift through the Paradise Papers.

Colin Ellis is managing editor of Canadian Accountant.

(0) Comments