Thought Leaders

Thought Leaders

Why is the CRA still targeting pandemic aid recipients?

Continued collection attempts against people who received pandemic benefits shows a punitive logic that doesn’t fit the scale of the alleged transgressions

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

What’s missing from the Davos agenda: taxing the rich

New polling shows that taxing the wealthy maintains majority support, even among the wealthy themselves. That should be reflected in international priorities

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Canada: Tax reform or tax collection?

Tax reform has received a lot of attention recently, without addressing the thorny issue of tax collection or enforcement, asserts Philip Maguire, CPA, CA

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Billionaires with $1 salaries ― and other legal tax dodges the ultrawealthy use to keep their riches

People who earn a lot through their job, from doctors to executives, are carrying the largest taxation burden, alongside lower-wage workers, says Ray Madoff

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Canada needs an open finance roadmap, not just open banking

Canada has a window to learn from open banking examples around the world and design an open finance roadmap that fits its own needs says Eric Saumure, CPA

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

What are the ethical issues that accountants should be aware of when using artificial intelligence?

When it comes to GAI, accountants can add the most value through their unique skills, such as model performance and reconciliation, explains Philip Maguire

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Rudeness is hurting auditors’ ability to protect the public — here’s how

A new study co-authored by Canadian accounting academics shows negative behaviour from clients should be treated as an risk factor — and provides solutions

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Alternative federal budget 2026: Taxation

As the Carney government prepares to unveil its budget on Tuesday, the Canadian Centre for Policy Alternatives has presented its Alternative Federal Budget

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Staying the course toward sound public finances

The absence of a federal budget underscores the importance of returning to fiscal consistency, says Université de Sherbooke taxation professor Luc Godbout

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

How accountants can combat inefficiencies

Bureaucracy, explains Philip Maguire, CPA, CA, is a curse on the ability to manage an organization in an effective manner, to the detriment of productivity

- COMMENTS 13

- LIKES 149

- VIEWS 160

Partner Posts

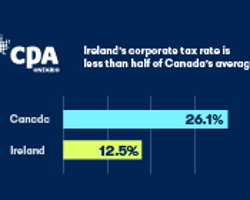

What can Canada learn from Ireland’s corporate tax approach?

Ireland shows that clear rules, competitive tax rates, and simplicity can help drive economic growth

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Remember who the tax system is for

Francois Boileau, Canada’s taxpayers ombudsperson, responds to the article, The forgotten project of tax reform, by François Brouard and Bertrand Lemieux

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Why Elon Musk’s US$34 billion loss wasn’t really that — and what it tells us about the philanthropy of the ultra-wealthy

One of the most strategically valuable (yet less publicly discussed) motivations of philanthropy is tax management, particularly the donation of shares

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

The forgotten project of tax reform

Despite differences, Canada’s federal parties recognize the need for an in-depth review. Now is the time to act, say François Brouard and Bertrand Lemieux

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Australia could tax Google, Facebook and other tech giants with a digital services tax — but don’t hold your breath

Unlike Canada, Australia thinks its hands are tied on the taxation of the multinational tech giants, in fear of retailiatory tariffs from the United States

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Oh, what a tangled web: The taxation of foreign affiliates

Allan Lanthier examines a dispute before the Tax Court of Canada involving Brookfield Corporation and controlled foreign affiliates in Bermuda and Barbados

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Why accountants should spend less time on the numbers and more time explaining the results

Accounting standards are becoming so complicated, says Philip Maguire, CPA, CA, that we have lost the ability to explain the results

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Optimizing Canada's balance sheet: The untapped value of natural assets

Canada’s natural assets could one day be reflected in government financial statements, says Bailey Church of KPMG, as the tides of accounting are shifting

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Why tax literacy should be a national priority in Canada

Now is the time for Canada to advance tax literacy, as both authorities and society as a whole can strengthen democracy and build a more informed public

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Who really killed Canada’s carbon tax? Friends and foes alike

While the tax could be replaced by an equally effective tool, its repeal increases uncertainty about Canada’s ability to support climate change mitigation

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

CPAs in 2025: Frustrated, overworked, and underappreciated

From uncertainty to compliance to staffing, Chartered Professional Accountants say their stress is not offset by client appreciation, reports Dean Blachford

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Trump’s tariffs threaten Indigenous businesses in Canada — the government must take action

Accounting Professor Douglas A Stuart and Indigenous Business Professor Andrew J. Karesa on supporting Indigenous business during a trade war and tariffs

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Trump, tariffs and Canadian tax strategies: There must be 50 ways to leave your country

Allan Lanthier explains how some Canadian corporations have redomiciled to the United States and why there may be more to come unless changes are made

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Why Trump’s plan to cut national debt by selling ‘gold card’ visas for US$5 million each won’t work

"If you’re a billionaire, you don’t need it," said one Canadian billionaire. "I don’t have to come to the United States to invest in the United States."

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Protecting CPAs using solicitor-client privilege

Chartered Professional Accountants may be enveloped into privilege if they are the client’s agent, pursuant to an agency agreement, explains Dean Blachford

- COMMENTS 13

- LIKES 149

- VIEWS 160