How are Canadian companies reporting cryptoassets?

New study from CBV Institute looks at financial reporting trends in cryptoassets

TORONTO, December 18, 2019 – How are Canadian companies reporting cryptocurrency assets? With the rapid proliferation of the cryptoasset market, there is still significant ambiguity in professional financial communities regarding this new asset class. The Chartered Business Valuators Institute (CBV Institute) has published a research paper in its Journal of Business Valuation that investigates valuation approaches and trends among Canada's 32 publicly traded companies with cryptoasset holdings or crypto-related revenues.

The Canadian accounting profession, including CPA Canada, EY Canada and PwC Canada, has published several resources regarding the primary issues involved in accounting for cryptocurrencies under International Financial Reporting Standards (IFRS). "There's a growing interest in blockchain technology across a number of industries, and cryptoassets will likely be an important part of valuation — and of business communities in general — in the foreseeable future,” says Tylar St. John, senior manager at Cohen Hamilton Steger & Co. “Our goal with this research paper is to close the knowledge gap between the small group of early adopters and the wider business community.”

The CBV Institute research found that, during the period of study, there continues to be a dearth of reporting guidance for this emerging asset class. However, the study did find a general alignment in the treatment of cryptoassets for financial reporting purposes. The majority of Canadian public companies appear to have applied a principles-based approach to financial reporting for cryptoassets, meaning these companies sought direction from a number of different reporting standards in an effort to classify cryptoasset holdings according to the anticipated use-case in their respective business operations.

The 32 publicly-traded Canadian companies featured in the study have an estimated combined crypto holding value of more than CAD$100M.1 The following provides a detailed look at trends in industries with cryptoasset holdings, a breakdown of the stock exchanges the companies are trading on and a review of their financial recordings:

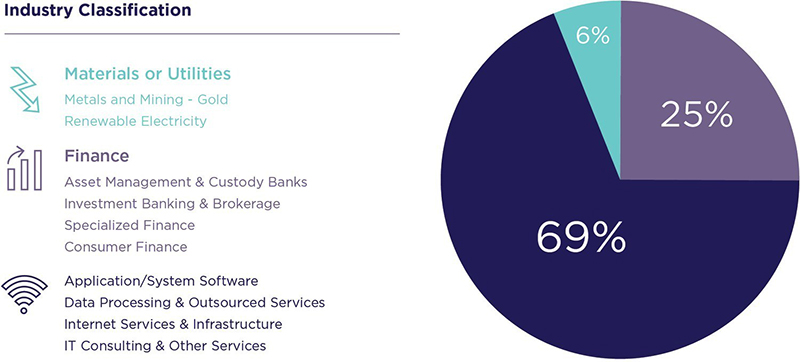

Trends in Industries with Cryptoasset Holdings

- Companies in the financial services industry (25% of the 32 companies) tended to have higher cryptoasset balances and market capitalization, primarily in asset management and investment banking and brokerage. This finding is consistent with a 2018 Cryptocompare study that found "cryptoassets in the finance and insurance sectors typically had higher market capitalization compared to other industry classifications."

- Materials, or utilities made up 6 per cent of the publicly-listed companies, highlighting a potential shift of focus for some companies away from physical resources and towards digital assets.

- The majority of the companies (69%) were information technology companies that generally provided software and services in the blockchain and/or cryptoasset space.

|

Trends in Industries with Cryptoasset Holdings (CNW Group/Chartered Business Valuators Institute). |

The Stock Exchange Breakdown

- Only two (6.3%) of the identified companies traded on the Toronto Stock Exchange ("TSX").

- The remaining companies listed on alternative exchanges including TSX Venture Exchange "TSXV" (53.1%), the Canadian Securities Exchange "CSE" (37.5%), which caters to junior and emerging companies not yet meeting the rigorous listing requirements of larger exchanges, and the NEO Exchange "NEO" (3.1%) a newly established Canadian exchange operational since 2015.

|

The Stock Exchange Breakdown (CNW Group/Chartered Business Valuators Institute). |

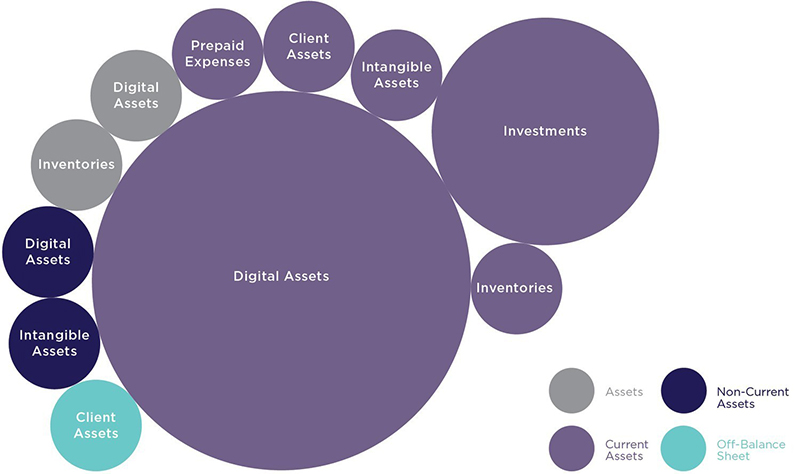

Breakdown of Financial Recording For Cryptoasset Holdings:

- The majority (85%) of the companies recorded their cryptoasset holdings within the "Current Asset" account.

- 15% of companies recorded cryptoasset holdings as "Non-Current Assets" or simply as "Assets"

- The majority of companies described their cryptoasset holdings using general terminology such as "Digital Assets" or "Cryptocurrencies."

- Less frequently, identifiers such as "Inventory," "Investments," or "Intangible Assets" were used to describe cryptoassets.

- One company operating in the financial sector disclosed a sizable 'off-balance sheet' cryptoassets interests held on behalf of clients.

|

Breakdown of Financial Recording For Cryptoasset Holdings (CNW Group/Chartered Business Valuators Institute). |

In addition to an in-depth look at Canada's 32 publicly traded companies with cryptoasset holdings, the study provides a primer to cryptoassets, select valuation methodologies, and factors that should be considered when investigating and valuing cryptoassets.

"The extraordinary pace of innovation in cryptoassets makes it challenging to keep up with this industry, but the fluidity that makes this space so difficult to grapple with is also what makes it so exciting,” says Tara Singh, senior manager at Cohen Hamilton Steger & Co. “While we can't predict the trajectory of cryptoassets in the long-term, we hope the findings of this study will alert professionals to the evolving valuation practices as a result of this new asset class — and ultimately help position Canada as a thought leader in this emerging space."

1 The researchers identified 32 Canadian-listed public companies which have, between January 1, 2017 and September 30, 2018, either held cryptoassets or earned revenue from cryptoasset-related activity.

By Canadian Accountant with files from the CBV Institute. To learn more, view the full research paper published in the Journal of Business Valuation.

(0) Comments