3 trends transforming the future of payroll in 2021 and beyond

Wagepoint cloud-based payroll solutions represent the future of payroll software

|

As the Community Manager at Wagepoint, Bianca Mueller, CPB, PCL strives to elevate the importance of education and compliance around payroll to set the bar for bookkeepers and accounting service providers across Canada. |

WITH small businesses (SMBs) in Canada employing 70 per cent of the total private labour force, it's important to look back at the last year and recognize the staggering challenges that businesses overcame during pandemic lockdowns. SMBs were forced to adapt and evolve with little-to-no warning all while navigating their way through new legislation, subsidies, government programs, safety procedures and regulations, and — in most cases — new technologies. All while finding ways to prioritize payroll and understand the cost of compliance.

According to the 2021 Canadian Small Business Resilience Report by Wagepoint, 52 per cent of SMBs say that the lessons they’ve learned during this time will make them better prepared for the future.

So, what lessons allowed us to transform our current payroll practice so that we could remain resilient and sustain our workforce as the economy recovers?

Payroll is no longer a back office function

In May 2021, I had the pleasure of presenting a popular webinar called “Payroll as a Function of Success and Resilience” alongside Steven Van Alstine, Vice-President of Education for the Canadian Payroll Association.

In summary, the payroll lessons we discussed were:

- Understanding how and where to invest in payroll.

- The importance of maintaining compliance.

- The importance of investing in people and relationships.

- How technology and software can help.

- How and when to implement change.

Steven and I agreed that the main takeaway from our research is this: Payroll is no longer a back-office function. Payroll is now at the forefront of every small business owner's mind. But, it isn’t always simple. The complexities of government legislation and subsidies over the last year required SMBs to look to payroll service providers for help with education, training, guidance and even outsourcing.

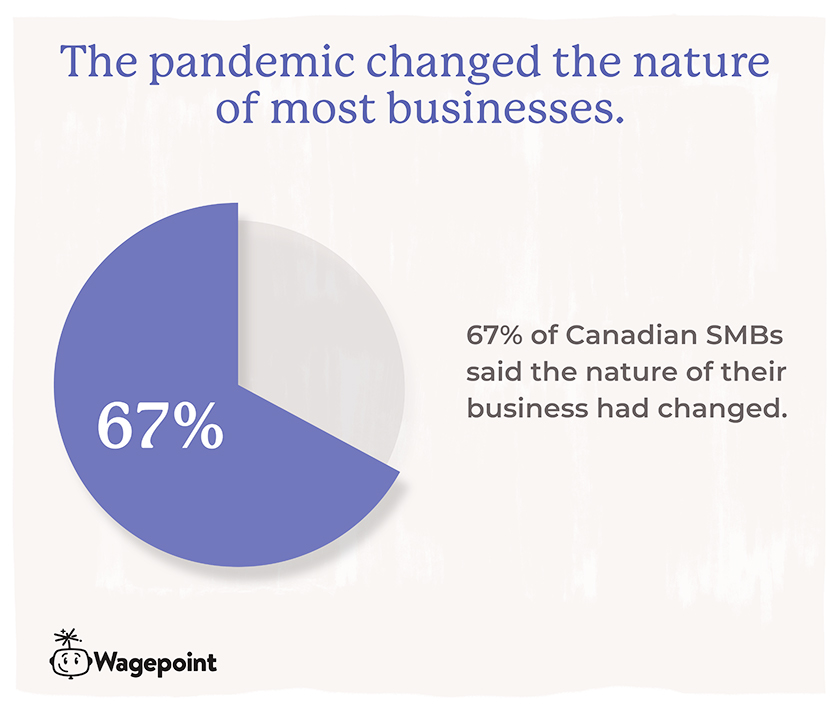

The small businesses surveyed by Wagepoint were very clear: They have no intention of going back to the way things were before the pandemic. In fact, in most cases (67%), the pandemic has forever changed the nature of their business.

|

As SMBs continue to adapt to new payroll protocols, new infrastructure and new technology, we can't help but recognize key new payroll trends emerging. |

Key Payroll Trends

1. Payroll as a key internal stakeholder

In the past, payroll had little-to-no crossover with other roles or departments within an organization (for the most part). But, with advancements in digitization, payroll as a service is being redefined. SMBs now expect more than just payroll processing from their payroll professionals.

The implementation of cloud-based payroll — with an ability to integrate with time-tracking solutions, e-banking and accounting software — has revolutionized payroll from data entry and calculations to being an essential part of the day-to-day business infrastructure. Today, payroll is a key internal stakeholder at the boardroom table, collaborating with departments like HR, finance, risk and IT.

2. Enhancing the employee experience

According to The Canadian Payroll Association Essential Benefits Survey, the most essential benefit of employment is accurate and timely payroll.

As more and more cloud-based accounting and payroll solutions integrate, we can't ignore the growing opportunity to “WOW” employees by providing an efficient and accurate digital “hub” that meets all of their needs in one spot. From onboarding to terminations, using a cloud-based payroll software that offers an employee portal for the distribution and storage of payroll data and documents is essential for real-time transparency.

Cloud-based payroll software also improves the digital employee experience by putting everything they need right at their fingertips: Time tracking, statutory holiday pay calculations, PIPEDA compliance and immediate filing, and access to employee-related government forms.This creates a smooth employee experience that is rooted in convenience, security and trust.

3. Transforming payroll with digital strategies

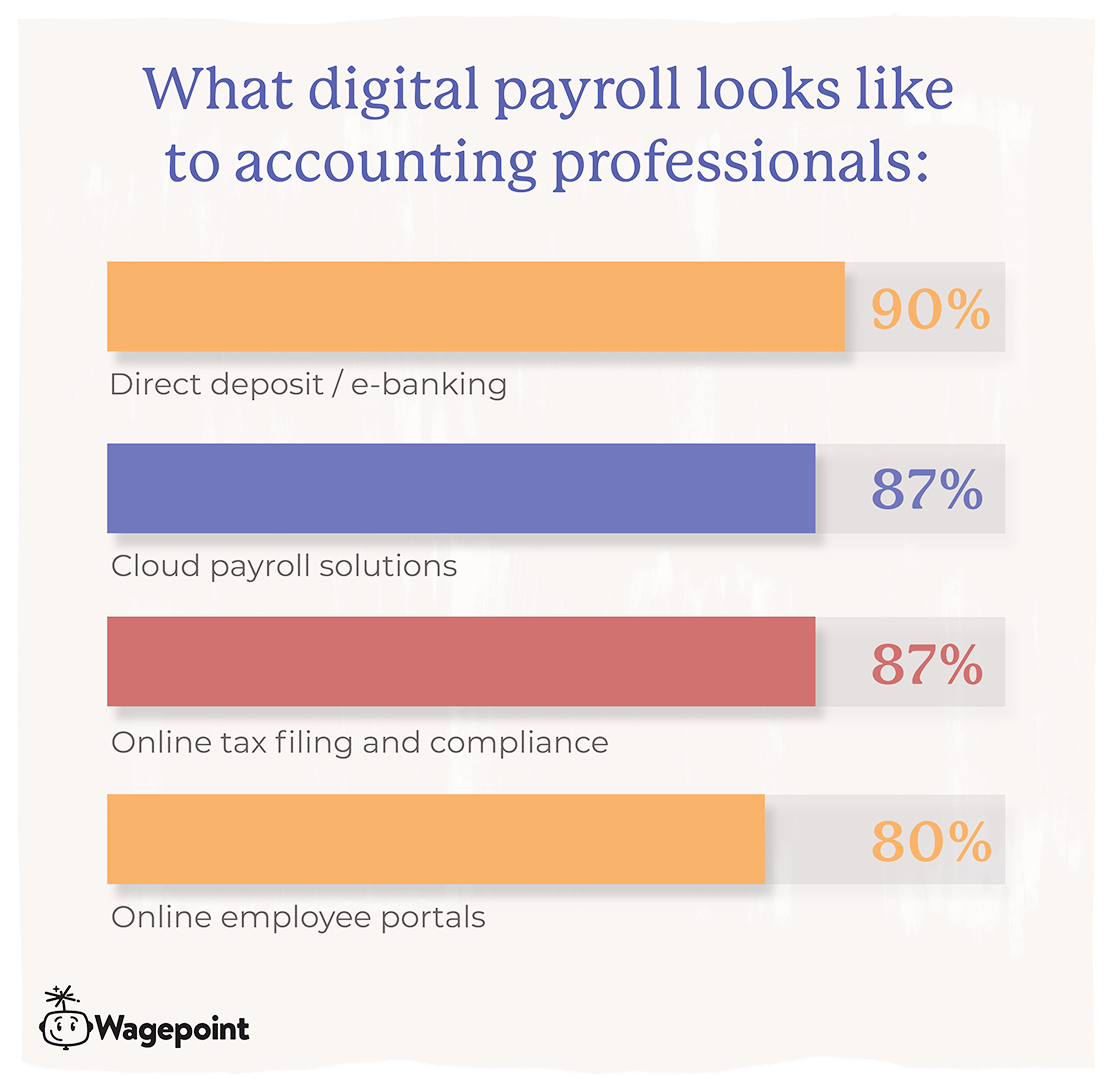

Digital payroll strategies include a variety of technologies and software solutions that can save SMBs and accounting service providers both time and headaches. During my “Payroll as a Function of Success and Resilience” webinar, accounting professionals were asked, “What does digital payroll look like to you?” Respondents indicated that they are focused on the digitization of direct deposit/e-banking; the use of cloud payroll solutions; online tax-filing and compliance; as well as online employee portals.

|

Courtesy: Wagepoint |

Ask yourself: Does your payroll software provide you or your firm with these digital payroll strategies? Do you offer or sell these as payroll features to incentivize your clients? Are these part of your current payroll practice? This poll is a clear indication of the way the industry is heading and thinking. Will you stay ahead of the pack?

“While much of a payroll professionals' work today will be automatable in the medium to long-term, organizations will benefit hugely from investing in payroll to gain insights from the vast amount of data available to the function. Through these investments, payroll can be a driver of technological adoption, innovation and growth.”

– Payroll in Focus: The Future of Payroll

As the Community Manager at Wagepoint, Bianca Mueller, CPB, PCL strives to elevate the importance of education and compliance around payroll to set the bar for bookkeepers and accounting service providers across Canada.

(0) Comments