Accountancy Insurance: 5 years supporting CPA firms across Canada … and counting

Roman Kaczynski of Accountancy Insurance on the growth of Audit Shield in Canada and where the CRA is focusing its audit activity

|

Roman Kaczynski is a director on the board of Accountancy Insurance. |

TORONTO – The genesis of the Accountancy Insurance story comes from an Australian CPA, frustrated with how much time was being written off due to taxation review activity. In the 18 years we have been operating in Australia and 10 in New Zealand, prior to stepping into the Canadian market, we have had the time to fine-tune our business operations and associated solutions for CPAs and their clients.

Today, a tax audit insurance solution to cover the cost of a client’s review or audit by the Canada Revenue Agency (CRA) and other federal and provincial revenue agencies is not a new idea. In fact, we have been offering our tax audit insurance solution, Audit Shield, to CPA firms across Canada since 2016.

It was certainly easier to create the demand for a new product based on those experiences gained before moving to Canada. When we started our business in Canada five years ago, the broad product, the core collateral, and the brand identity all had been tried and tested. However, not everything is the same.

Although Australia and then subsequently New Zealand were very similar markets to each other, we learned that our Commonwealth partner Canada, is very different.

Because what we do and how we do it is unique and proprietary, we gave some of our key people from down-under the opportunity to move to Canada to start the ball rolling. As expected, I was inundated with applications from our Australian and New Zealand teams of those that wanted to move to Canada and offer CPAs in Canada what they had been offering their local CPAs for so many years.

I selected the team members based on their experience. I did my tour of duty through Canada to start the ball rolling with invaluable support from Melisa Ouw-Chang during that set-up period. Operations in Canada were just getting started when Sharon Smith joined the team from New Zealand and really got the momentum happening.

Today, we have Vicky Shah from Australia and Mat Sutcliffe from New Zealand, together with Sharon, pushing that momentum forward. Melisa and Mat love the experience so much that they are now living in Canada permanently. Along the way, we have recruited many “local” Canadians who have really complemented our objectives and are playing big roles in driving our business forward. We definitely feel there is a connection that Australians, New Zealanders and Canadians share in humour and in attitudes.

Getting around Canada

Initially based solely in Toronto, our teams have spent plenty of time crossing the country. Today we have offices in Toronto and Calgary, meaning we can effectively support CPAs in Canada from east to west. The opening of our Calgary office in 2019 also meant our team got significantly larger — one that continues to grow, even today.

However, you cannot talk about travel in Canada without talking about driving in winter! There was certainly a challenge there for many of us to overcome. All of the expat team members have stories to tell of their experiences driving in Canada, both good and bad.

One thing has remained the same throughout our continued journey: Our dedication to supporting the CPA firms around Canada with a constantly evolving cost solution. We are proud to work with a broad range of accounting firms — from sole proprietors to multi-partner firms. We also believe that the accounting community is just as tight-knit and supportive as it was when we started in Canada back in 2016.

The Canadian tax system

Although there are similar principals in the various tax systems, our observation is that “Geez, there are a lot of layers and unnecessary complications in the Canadian tax system!” Mainly because of the various provinces having the right to implement their own taxation.

Add to that, some returns, like GST/HST, need to be calculated taking variable circumstances into account. This can change every time a GST/HST return is filed. Therefore, the only way to validate a return is by an involved audit process by the CRA.

The complication of a T1 return, mainly based around the Benefit Return section, is good for accountants — in that it is hard to get the best result without an accountant — leads to the very inefficient requirement by the CRA to undertake processing reviews to keep the system honest.

Our review of the outcomes of CPAR’s and processing reviews show over 80 per cent of the reviews we see in claims submitted have no adjustment. Our initial research into the Canadian market showed a lot of minor audit activity at the processing review level and at the corporate post assessment review level, but we definitely underestimated how much more that was.

Although our product would still be considered very affordable for the businesses that want it, the result from the initial misjudgment of activity levels has been that we have spent some of that first five years working to get the balance right between premiums and claims.

Practice Management Software

A complication we have in our Canadian business is the wide spread and use by the accounting profession of independent software solutions that don’t always integrate with our usual method of operations. Given that our modus operandi is the interpretation of the accountant’s client data into a targeted offering for the accountant to make, this spread of client data means we need to use more than one data source to undertake our task, whereas, in Australia and New Zealand, accounting practice systems are integrated around a “one source of truth” CRM.

Our solution in Canada is continuing to use our data conversion skills that we have honed over 18 years to effectively deliver our solution, as we continue to look for further opportunities to streamline the process.

Our experience and insight into CRA review and audit activity

During the COVID-19 pandemic, we saw a slowing of some types of Audit Shield claims originating from CRA reviews and audits. However, we note that this did not affect all Audit Shield claim activity in Canada. For example, CRA Business Reviews of GST, HST, PST, and QST (pre- and post-assessment) did not stop throughout 2020. Any lull in audit activity has been short lived as today, the CRA and other federal and provincial revenue agencies have returned to those nuisance 2019 pre-Covid levels.

Since we entered into the Canadian market in 2016, we have processed tens of thousands of Audit Shield claims originating from CRA reviews and audits. That number continues to grow every day. As we become more established in the Canadian market, we have ascertained a very comprehensive snapshot of CRA review and audit activity. Our experience over the last five years extends not just to what CRA review and audit types are the most prevalent, but also which category of taxpayer submitted the most number of Audit Shield claims.

This adds up to a very clear picture of where the CRA has been focusing their review and audit activity over that period. For example, business groups with under $3M revenue have submitted the highest number of Audit Shield claims, representing almost 60 per cent of all claims made over the last five years. Processing Reviews of T1’s represented the most frequent claim type, with close to 40 per cent of all Audit Shield claim activity.

From the beginning of 2021, the CRA has been slowly ramping up its review activity. Business reviews of GST, HST, PST, QST, and processing reviews of T1’s continue to feature regularly with our claims team. A claim category that has grown a lot since May 2021 is the number of corporate post assessment reviews (CPAR's) focusing on capital cost allowance. In prior years, we have seen professional fees and vehicle expenses examined under this category. This also shows no signs of slowing. On top of that, we are seeing the CRA’s T1 processing reviews season well and truly back in play. We are sure you are feeling this.

Survey Says: The CRA will continue to increase its audit activity

|

CLICK TO ENLARGE. |

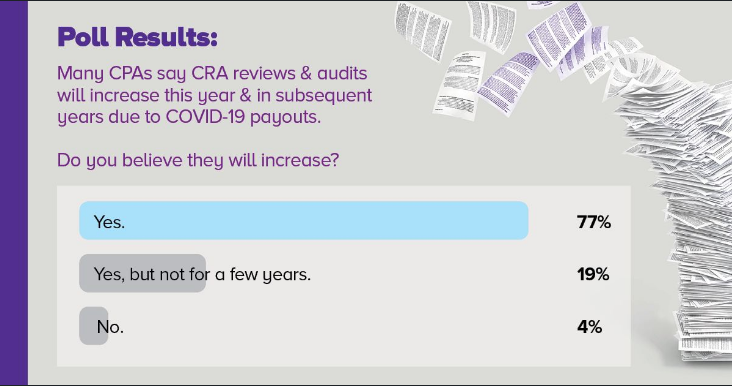

We recently ran a poll asking CPAs around Canada if they believe that CRA reviews and audits will increase due to COVID-19 payouts. Of those that responded, 77 per cent said YES and a further 19 per cent said they would increase in the coming years.

How does that transpire to what we have experienced in claims activity in the last five years? We think the results of the survey reinforce that the accounting community is also feeling what we are seeing in our data. We are sure your CPA firm is feeling this too.

We expect that Audit Shield claim activity will continue to increase and are fast returning to pre-COVID levels, and perhaps exceed this level of activity as the government attempts reduce its substantial COVID-19 related debts.

What does this mean for the remainder of 2021 and for the years ahead? Based on the claim trends that we are seeing now — and due to the numerous CRA compliance measures — reviews and audits will almost certainly continue.

When the CRA puts out a campaign highlighting a particular category, they are in essence warning taxpayers that this is where they will soon be focusing their review and audit attention. We have seen this more recently with the CRA targeting SMEs, high-wealth individuals, taxpayers with excessive work-from-home claims, some specific aggressive tax planning strategies, and those not properly declaring cryptocurrency exchanges.

With five years of experience in Canada, we would consider our Canadian business to be established, robust, with a good level of momentum. We continue to enjoy the ability to do business in Canada, and love dealing with Canadian CPAs who, as a general statement, we find are professional, dedicated, hardworking, have integrity and honesty, and most of all, can laugh at our jokes, even if only politely to the bad ones.

For all of those CPAs that continue to trust us and for those still deciding, we say a solid “thank you” for being on our journey. Let us hope, one day soon, that our “in person” paths will cross again. We also hope that the next five years and all of those years that follow are just as mutually great.

Roman Kaczynski is a director on the board of Accountancy Insurance. All images provided by Accountancy Insurance.

Not a client yet? Never worry about fee write offs again

Payroll, GST, HST, PST, QST, Corporation Post Assessing Review (Vehicle Expenses, Professional Fees, etc.), T1 Processing Reviews, Trust Account ... In the past, when a client is subject to CRA review activity, CPAs tended to compensate by charging the client the real cost of their professional services or the CPA would simply write off their fees to keep the client happy. Either way it’s a no-win situation and the CPA needed to have an awkward conversation with their client.

Is your CPA firm still writing off fees for responding to CRA reviews and audits of your client's filed returns in these areas — and more? Are you tired of it and wish there was a better way? We can assure you, there is. Hundreds of CPAs across Canada know about it and utilize it — and it's called Audit Shield.

(0) Comments