An accountant’s tale of identity theft

What happens when your personal information is stolen by a notorious fraudster? Wayne Haymer shares his story

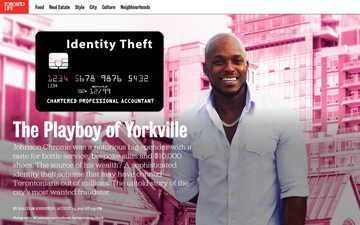

TORONTO – Chartered Professional Accountant Wayne Haymer was caught by surprise when his name appeared in connection to an infamous Toronto fraudster, “Johnson Chrome,” in "The Playboy of Yorkville," from the current issue of Toronto Life.

“I found that article to be a big shock,” says Haymer, a manager at the accounting firm of Newman & Sversky in Toronto. Based on his experience, “I can understand why the majority of fraud goes unreported,” he says. Haymer agreed to be interviewed by Canadian Accountant to warn other CPAs about identity theft.

Toronto Life reporter Malcolm Johnston found Haymer through court documents related to one Adekunle Johnson Omitiran, born in the slums of Nigeria, a Canadian citizen currently in jail for violating his parole. Omitiran, as “Johnson Chrome,” had lived the high life before his arrest last April.

“A notorious big spender with a taste for bottle service, bespoke suits and $10,000 shoes,” according to Toronto Life’s sensational headline. “The source of his wealth? A sophisticated identity theft scheme that may have conned Torontonians out of millions.”

In Omitiran’s Yorkville condo police found $39,200 in cash, a “massive footwear collection ... two closets were filled with bespoke suit jackets, watches, dress shirts, cologne and sunglasses.” They also found 37 stolen credit cards, a mass of stolen mail, and the personal information of Haymer.

Omitiran ran a successful, if labour-intensive, game. His alleged modus operandi was to slip into apartments and condo buildings without security or concierges and access their mail rooms and boxes. He would then collect as much mail as he could, learn the contact and personal information of the building’s residents, and apply for new or replacement credit cards. He would then return to the same buildings and collect the credit cards when they arrived by mail.

Haymer’s nightmare began when, in 2016, his credit card was declined at a gas station in Toronto. As Toronto Life describes it:

Haymer was puzzled. He’d used the card the night before, and he was careful to always pay off the balance. He called his bank’s credit card fraud number, but the line was so backed up that it took him three days to get through. Finally he reached a representative, who explained that his card had been charged twice, for a total of $1,800, at an east-end Loblaws that Haymer had never visited.

The identity theft nightmare begins

Thus began a Kafkaesque journey for Haymer through banking bureaucracy. “It took me several days of phoning the bank, trying to report a fraudulent transaction on my credit card, and when I did reach an operator, I was refused help,” says Haymer. “I was told that the credit card agreement stated that any purchase made on a card containing an embedded chip was the responsibility of the card holder.”

The computer chip — technically called an EMV chip — creates a unique signature for each transaction, and shifts the liability from banks to merchants and consumers. Haymer says the banking institution made him feel like a “swindler.” He was ready to write the whole thing off when the bank finally called to say they had photo of a man who had changed Haymer’s PIN at an ATM.

According to Haymer, the bank's representative said, “We have a photograph but we will only hand it over to the police if you file a police report.” He is still bothered by his treatment, though he credits the one bank employee who called him with the news.

“Banks persuade consumers to purchase credit products beyond their needs,” he says, “yet when there is a problem, such as losses due to fraudulent use of these products, banks are slow or neglect to provide any assistance to their customers. They encourage electronic transactions and then rotate their employees amongst different branches, making it difficult to establish relationships with them.”

Haymer recovered his losses, “but it cost me a week from my work plus aggravation to a point where I almost gave up.” He recommends that replaced, renewed and new credit cards should be picked up at banks (after showing photo ID), "not issued through regular mail where they can be intercepted or sent to the wrong address.”

Having been burned by identity theft once, Haymer has taken other measures. “I no longer receive credit card statements by mail — only online,” he says. “And I disengaged the ‘tap’ feature on both my credit and debit cards, because information can be retrieved fraudulently by electronic devices.”

The Toronto-based accountant also purchased, “for a nominal fee,” Trans Union Victim Assurance, “which alerts creditors who access my credit reports of my credit card fraud experience and to contact me directly before extending credit.”

Haymer also contacted Equifax to examine his credit report and to ensure his credit rating was not adversely affected. He says it’s ironic that Equifax itself has been the recent target of a massive fintech crime that has compromised its database. “This just shows how vulnerable we are all in terms of identity theft.”

Canada soft on identity theft, fraud

Chrome’s trial will likely take place in 2018, according to Toronto Life, but many are sceptical of the outcome. Canada has a reputation for being soft on financial crime, particularly on criminal transactions such as money laundering and identity theft fraud, including credit card crime, as compared to the U.S.

Further, despite a reported $939 million in credit card fraud in 2016 alone, “banks, though they won’t admit it, tend not to waste their time chasing small sums, which they can quickly reverse,” according to Toronto Life.

A public-spirited professional accountant, Haymer has an altruistic streak. He is a fellow of CPA Ontario (FCPA), due in no small part to years of volunteer experience at his legacy body, and his work in China with business students. The Toronto Life reporter had a difficult time finding victims who would go on record. “The only reason I said ‘sure’ is because I thought I would be helpful in promoting an awareness of identity theft," says Haymer, "and what is happening at the banks.”

After the article in Toronto Life was published, Haymer took one additional precaution. He met with his condominium’s property manager and board of directors to discuss the lack of security in his building.

Colin Ellis is the editor-in-chief of Canadian Accountant. Image of Toronto Life layout with royalty-free credit card image superimposed.

(0) Comments