What can Canada learn from Ireland’s corporate tax approach?

Ireland shows that clear rules, competitive tax rates, and simplicity can help drive economic growth

CANADA faces deep economic challenges. With rising global trade uncertainty and U.S. business taxes becoming more competitive through the recently passed One Big Beautiful Bill Act, Canada’s corporate tax system warrants attention. Prime Minister Mark Carney’s campaign pledge to review it is timely.

As the Carney government prepares its first budget this fall, it could look to Ireland for insights on a bold approach to corporate taxation. A commitment to a low headline rate differentiated Ireland as an investment destination and contributed to its remarkable economic transformation.

Canada’s Corporate Tax Rate — Not What It Once Was

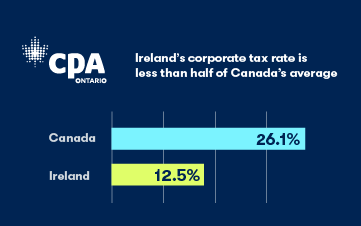

Canada has undertaken corporate tax reform before. In the late 1990s, a review led by economist Jack Mintz spurred bipartisan action to improve business tax competitiveness. Both Liberal and Conservative governments, federally and provincially, reduced the combined statutory corporate tax rate from over 42% to today’s average of 26.1%. While these reforms made Canada more competitive at the time, other nations haven’t stood still. Canada’s combined corporate tax rate now exceeds the U.S average (25.6%) and the OECD average of 23.9%.

Irish Case Study on Corporate Tax Policy

Ireland, with its commitment to a low headline corporate tax rate, offers a compelling case study for how policy can drive competitiveness and growth. Between 1997 and 2003, Ireland reduced its corporate tax rate from 36% to 12.5%, which is less than half of Canada’s current average.

A clear, predictable, and low rate provided certainty to investors. Once among the poorest countries in Western Europe, Ireland has become one of the richest on a per capita basis. In the early 1990s, Canada’s real GDP per capita was significantly higher than Ireland’s. Today, Ireland’s GDP per capita is roughly double Canada’s.

While Ireland’s economic statistics have faced scrutiny, with some attributing a 2015 GDP surge to multinational corporations shifting intellectual property for tax purposes, the broader economic transformation is difficult to dismiss. Estimates from the Irish government suggest the 12.5% corporate tax rate increased the country’s gross national product by 3.7% .

Beyond the low corporate rate, a key insight from Ireland is its underlying philosophy. Ireland prioritized simplicity and competitiveness in its tax system, favoring low rates over complex tax credits. Ireland also capped its top marginal tax rate for individuals at 40% and used a patent box regime to spur innovation. The tax system helped attract high-value sectors like technology, pharmaceuticals, and financial services, and positioned the country as a preferred destination for multinational investment.

The key lesson is that clear rules, competitive rates, and a commitment to simplicity can create a pro-growth environment.

Tax reform alone didn’t solely account for Ireland’s economic transformation; it played a powerful reinforcing role with other structural changes. Ireland actively developed a highly educated workforce and fostered a pro-business regulatory environment. It simplified administrative processes for foreign investors and built strong connections between academia and industry. The government aimed to be seen as a reliable and welcoming partner for global companies.

Implications for Canada's Economic Future

Significant reductions to Canada’s corporate tax rate could provide the signature policy Canada needs to stimulate investment and economic activity, especially with U.S. tax policy developments intensifying competitive pressures on Canada.

President Trump’s One Big Beautiful Bill Act, passed on July 4, 2025, extends some expiring provisions from the 2017 Tax Cuts and Jobs Act while making others permanent. It introduces new measures to boost investment, including permanent full expensing for short-lived assets and domestic research and experimentation (R&E).

The administration also negotiated a deal with the G7 to exempt U.S. multinationals from the OECD’s 15% global minimum tax, potentially giving them an additional tax advantage. And if Trump follows through on his campaign pledge to lower the federal corporate tax rate to 15%, the U.S. would become even more attractive for investment relative to Canada, especially in light of tariff uncertainty.

Conclusion

Corporate tax reform is a significant policy lever, though alone it won’t cure Canada’s economic challenges. Improved economic growth will require a comprehensive strategy, including reforming personal taxes, reducing red tape, strengthening competition, boosting innovation, and investing in productive-enhancing infrastructure.

Prime Minister Mark Carney’s pledge to launch “an expert review of the corporate tax system based on the principles of fairness, transparency, simplicity, sustainability, and competitiveness” signals potential change. Ireland’s success demonstrates that coherent tax policy, anchored in low rates, clear rules, and a commitment to competitiveness, can drive long-term growth. Canada can seize this opportunity and act boldly.

Stay informed with CPA Ontario Insights — a source of public policy and thought leadership for CPAs. Subscribe here.

Partner Post sponsored content and title image courtesy: CPA Ontario.

(0) Comments