Thought Leaders

Thought Leaders

Filing taxes for someone else? Here’s how to do it safely

An academic study reveals that informal tax preparers — friends and family, not professional accountants — are not using the Canada Revenue Agency’s RepID

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Why is the CRA still targeting pandemic aid recipients?

Continued collection attempts against people who received pandemic benefits shows a punitive logic that doesn’t fit the scale of the alleged transgressions

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

What’s missing from the Davos agenda: taxing the rich

New polling shows that taxing the wealthy maintains majority support, even among the wealthy themselves. That should be reflected in international priorities

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Canada: Tax reform or tax collection?

Tax reform has received a lot of attention recently, without addressing the thorny issue of tax collection or enforcement, asserts Philip Maguire, CPA, CA

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Billionaires with $1 salaries ― and other legal tax dodges the ultrawealthy use to keep their riches

People who earn a lot through their job, from doctors to executives, are carrying the largest taxation burden, alongside lower-wage workers, says Ray Madoff

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Canada needs an open finance roadmap, not just open banking

Canada has a window to learn from open banking examples around the world and design an open finance roadmap that fits its own needs says Eric Saumure, CPA

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

What are the ethical issues that accountants should be aware of when using artificial intelligence?

When it comes to GAI, accountants can add the most value through their unique skills, such as model performance and reconciliation, explains Philip Maguire

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Rudeness is hurting auditors’ ability to protect the public — here’s how

A new study co-authored by Canadian accounting academics shows negative behaviour from clients should be treated as an risk factor — and provides solutions

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Alternative federal budget 2026: Taxation

As the Carney government prepares to unveil its budget on Tuesday, the Canadian Centre for Policy Alternatives has presented its Alternative Federal Budget

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Staying the course toward sound public finances

The absence of a federal budget underscores the importance of returning to fiscal consistency, says Université de Sherbooke taxation professor Luc Godbout

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

How accountants can combat inefficiencies

Bureaucracy, explains Philip Maguire, CPA, CA, is a curse on the ability to manage an organization in an effective manner, to the detriment of productivity

- COMMENTS 13

- LIKES 149

- VIEWS 160

Partner Posts

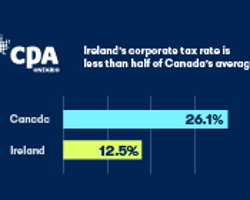

What can Canada learn from Ireland’s corporate tax approach?

Ireland shows that clear rules, competitive tax rates, and simplicity can help drive economic growth

- COMMENTS 13

- LIKES 149

- VIEWS 160