4 ways Canadian accountants can grow their business and scale their impact

Technology will continue to be a key driver of growth for practitioners and their clients, says Graham Sharples of Intuit QuickBooks Canada

AFTER a year of economic uncertainty, small business clients across Canada have needed the guidance of accountants more than ever. Your expertise has helped them to tackle new business problems like navigating COVID-19 support programs such as the Canada Emergency Business Account (CEBA) and Canada Emergency Wage Subsidy (CEWS). By alleviating the stress of operating in a new world of work, your efforts have enabled the backbone of our economy to evolve and create change. All the while equipping your clients with the support and insights they need to protect, sustain, and grow their business.

Yet many Canadian accountants believe we are not moving fast enough, and there is a need for innovative tools and resources to help manage this shifting landscape. You want to make your firm more resilient. You want to scale your firm. As Covid-19 continues to impact your clients, you may be looking for new ways to be more efficient, grow your advisory capabilities and improve collaboration within your firm. You want to speak the language of entrepreneurship to help make stronger small businesses.

Here are four ways you can get started.

Recognize that compliance is one of the biggest barriers to growth

As you may know, compliance is time consuming. This will not change, as the new standard for Compilation Engagements comes into effect by the end of 2021, with the updated CSRS 4200 regulation. Year-ends and taxes will become more taxing. You already spend a lot of time collecting, organizing, managing data and conversations across multiple apps all to complete a single engagement. How can you make sure that your firm is ready for these changes?

Make sure that the solutions you use provide you with the most efficient means to manage your data and clients. Count the steps it takes to complete just transferring your client’s data across the apps you use to complete a year-end. Each of these steps takes you further away from your goals. And make sure that, like QuickBooks Online Accountant, your year-end solution will support features like the soon-to-be-released updated ‘Notes to the Financial Statements’, a Retained Earnings report, and new guidance templates to keep you compliant and help you navigate this year’s changes with ease.

Add consulting services to your repertoire

Go beyond doing the books or compliance to establish yourself as a small business thought leader. This opens the door to growing your business and generating additional revenue, while diversifying your customer base and creating multiple income streams that help mitigate potential losses in revenue if an area of your practice lags behind.

You can prove your expertise by putting on educational workshops and seminars for your existing clients. The key here is to ask them to invite other business owners in their network to attend and turn these opportunities into referrals or warm leads for your services. What’s more, this positions you as an expert in your field and may warrant an increase in your billable rates.

To take it a step further, consider expanding the accounting services you offer into the advisory services realm to demonstrate the value of your expertise. You could move into helping clients who are developing new products’ cost out their rate and distribution process, or you can establish yourself as a financial expert ready to help businesses with their expansion plans. As you grow your line of services in this way, you make yourself more valuable as a consultant.

Rethink your workflow management system

Updating your workflow and process is a great way to shore up your firm. Managing your workflow and creating clear steps for each process can benefit both you and your clients. But to modernize your approach and maximize efficiency, it’s best to evaluate and test new applications to streamline your workflow.

To get going, start by assessing how your firm is using technology. Ask yourself a few questions. Have the same old jobs gotten easier or faster to complete? Have communications with clients and staff improved? Have we removed steps managing my clients’ data? Has it become more cost effective to maintain? How many apps do we actually use? Then determine if your current approach to managing tasks is leaving any loose ends. Finally, evaluate how your practice resources are being analyzed and allocated.

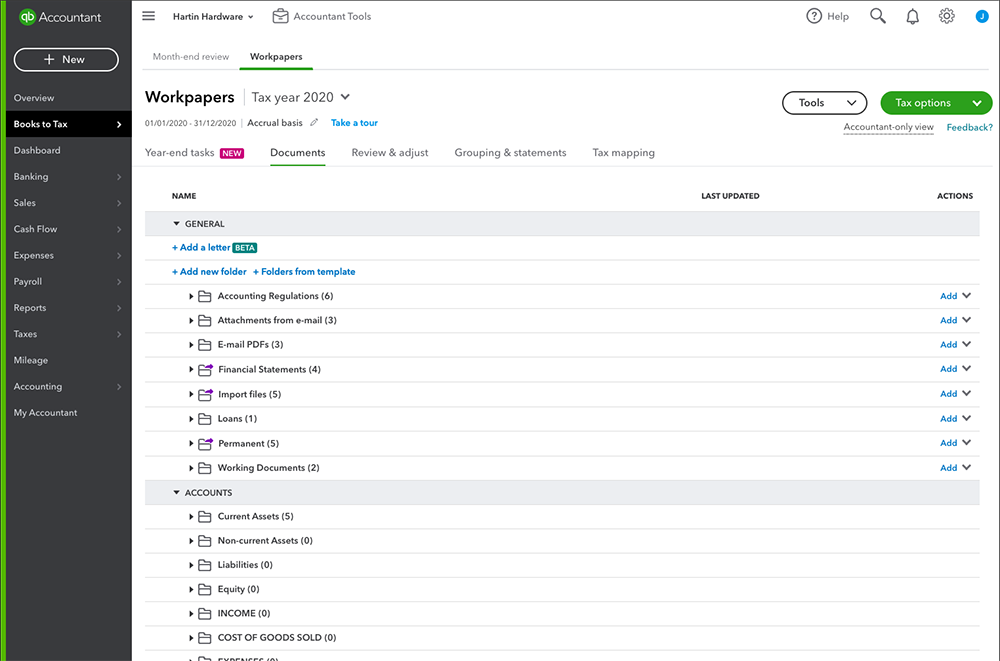

One thing that we hear often is that many of you use multiple apps to complete a year end. We know that ideally, integrating all of the systems you’re currently using to create one seamless streamlined workflow is preferable. Using tools that sync data together to remove steps to free up your time is what you’ve told us you want. The year-end workflow from QuickBooks Online Accountant is a great way to get started.

|

Intuit QuickBooks Accountant Workpapers screenshot. CLICK IMAGE TO ENLARGE. |

Leverage the latest innovations in accounting technology

Our world of work has become increasingly digital with new software, tools and features to help scale the impact of your business. Moving forward, technology will continue to be a key driver of growth for you and your clients. By implementing new tools to streamline processes and grow your advisory capabilities, you’ll not only be able to keep pace with today’s accelerated digital transformation, but you’ll also be ahead of the curve – giving you an edge over competitors.

Our teams continue to work hard to make sure that you have complete confidence in your data, save time and stay compliant from books-to-tax. Unveiled at this year’s QuickBooks Connect Canada, you’ll soon be able to bring your Trust or T3 work into Pro Tax, allowing you to file T3 taxes in the same place you do your books and year-ends. These are the kinds of tools that will help scale your service offering and bring you closer to becoming a one-stop shop for all your clients’ needs.

Disclaimer: This information is intended to outline our general product direction, but represents no obligation and should not be relied on in making a purchasing decision. Additional terms, conditions and fees may apply with certain features and functionality. Eligibility criteria may apply. Product offers, features, functionality are subject to change without notice.

Graham Sharples is the Head of Product, Accountant Ecosystem for Intuit QuickBooks Canada. Over twenty years, Graham Sharples has built a record of delivering delightful product solutions across a wide range of industries. A passionate advocate for accountants, bookkeepers, and tax preparers, Graham’s team continues their push to develop unique solutions that solve big problems through partnerships with accounting professionals like you.

(0) Comments