CRA eyeing influencers, video game streamers for unreported taxes

Canadian influencers earn millions and the CRA wants its cut, says tax accountant and lawyer David Rotfleisch

|

David J Rotfleisch, CPA, CA, JD, is the founding tax lawyer of Rotfleisch & Samulovitch P.C., a Toronto-based boutique tax law firm. |

TORONTO – On December 3, 2020, the Canada Revenue Agency (CRA) confirmed that its auditors are watching Canada's social media influencers and video game streamers to determine whether their paid endorsements and income from social media and online video games are fully reported in their personal income tax filings. According to the CRA, the purpose of keeping a close eye on social media influencers and video game streamers is to identify tax evading taxpayers, encourage compliance with Canada's tax system and collect taxes on unreported income.

The CRA conducted initial research surrounding income earned by social media influencers and video game streamers and it is currently in the process of finalizing an enforcement plan that encourages compliance with Canada's income tax system. The CRA's enforcement plan will focus on social media influencers and video game streamers with income earnings of above $500,000 annually.

The CRA is relying on open-source intelligence to help identify unreported income earned by social media influencers and video game streamers. Open-source intelligence is a multi-method approach whereby the CRA collects, analyzes and makes decisions based on data retrieved from the Facebook and Twitter pages associated with social media influencers and video game streamers. According to the CRA, open-source intelligence has led to the contact of certain vendors associated with the targeted social media influencers and video game streamers.

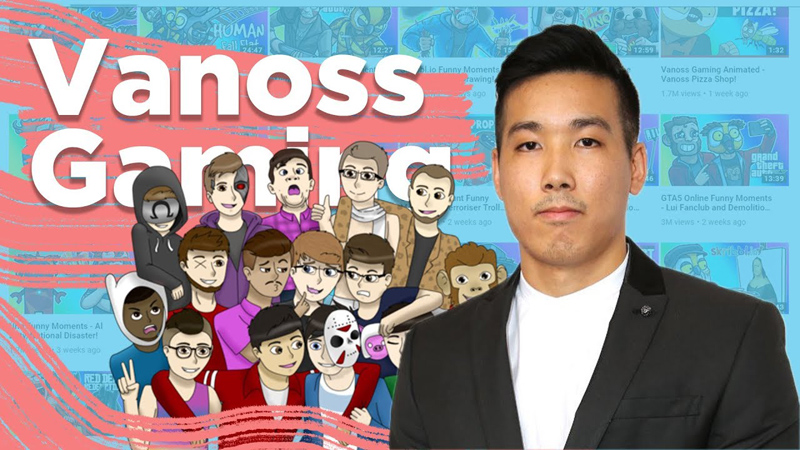

The CRA explained that its enforcement plan aims to educate social media influencers and video game streamers about their tax obligations, pursuant to Canada's income tax legislations, and then check to see if they respond accordingly. According to the CRA, based on its initial research, many Canadian social media influencers and video game streamers are earning millions of online followers on sites such as YouTube and Amazon and have become high income earners through subscription fees and merchandise sales. For example, Evan Fong of Richmond Hill, Ontario, has more than 25 million subscribers of his VanossGaming Channel and it is reported that his 2018 earnings were approximately $17 USD million.

In an effort to increase enforcement with Canada's tax law, specifically in context of social media and video-gaming, the CRA intends to reach out to consulting businesses to ensure that they are aware of the digital tax legislation, which will become applicable effective as of July 1, 2021. The new digital tax legislation will require digital corporations such as Google, Netflix and Airbnb to collect federal sales tax from Canadian consumers.

However, Parliament has yet to approve this new legislation. The CRA anticipates that requiring international digital platforms such as Google, Netflix and Airbnb to register for and collect federal sales tax from Canadian consumers will raise $1.2 billion dollars over the next five years. It has also said that it is prepared to apply a new corporate tax on digital services, if needed. Further, the CRA announced that over the next five years it will have $606 million dollars in new funding to support programs that target international tax evasion and aggressive tax avoidance.

|

In 2015, the Canadian Press estimated that Evan Fong of Richmond Hill, Ontario was making $300,000 per month as a video gamer and influencer. In 2017, he became the second-highest earner on YouTube, with his Vanoss Gaming channel earning an estimated $15.5 million for 2017 alone. |

The CRA and social media platforms

The CRA has long monitored social media platforms to determine whether taxpayers are posting information and content that are inconsistent with their reported income. As such, keeping an eye on social media influencers and video-game streamers in search for tax revenues reflects CRA's ongoing effort at ensuring compliance with Canada's tax system, particularly in context of e-commerce transactions and digital platforms. The CRA's enforcement plan also reflects its initiatives at addressing issues pertaining to international tax evasion and aggressive tax avoidance, as well as encouraging transparency and fairness throughout Canada's tax system.

However, it is not clear how efficient the CRA's enforcement plan will be in context of identifying unreported revenue generated through e-commerce transactions and digital platforms.

The CRA's application of open-source intelligence is also problematic. There are ongoing concerns associated with the reliability of information and data retrieved from the internet including social media platforms such as Facebook and Twitter pages. Even if the application of open-source intelligence generates persuasive evidence, it is inconclusive. As such, collecting, analyzing, and making decisions based on data retrieved from the Facebook and Twitter pages can lead to misrepresentations, mistakes and improper behaviour by CRA agents, which can create financial hardships for Canadian taxpayers.

As previously mentioned, the CRA's enforcement plan is focused on social media influencers and video-game streamers with income above $500,000 annually. This may be problematic because it could potentially shift the CRA's focus away from enforcing Canada's Income Tax Act on social media influencers and video-game streamers with income below $500,000 annually.

Focusing on social media influencers and video-game streamers with income above $500,000 does not address the ongoing non-compliance issues of Canada's tax systems, in context of e-commerce transactions and the digital world but also with respect to unreported cash sales. While it is important to set audit criteria, the CRA's narrow approach appears to turn a blind eye to social media influencers and video-game streamers with tax revenue below $500,000, who may also have significant unreported income.

Options for social media influencers

Social media influencers or video-game streamers who are undergoing a CRA tax audit or have unreported income earned through social media or online video-games may qualify for relief through the CRA's Voluntary Disclosures Program (VDP). The purpose of the VDP is the avoidance of "tax evasion and aggressive tax avoidance" to ensure a tax system that is responsive and fair for all Canadians.

It promotes compliance with the law and allows taxpayers the opportunity to voluntarily (1) correct inaccurate or incomplete information; and/or (2) disclose to the CRA information which was not previously reported. In this context, Canadian taxpayers who have unreported income earned through social media or online video-games may be eligible for penalty relief and partial interest relief under the VDP.

David J Rotfleisch, CPA, CA, JD, is the founding tax lawyer of Rotfleisch & Samulovitch P.C., a Toronto-based boutique tax law firm. With over 30 years of experience as both a lawyer and chartered professional accountant, he has helped start-up businesses, resident and non-resident business owners and corporations with their tax planning, with will and estate planning, voluntary disclosures and tax dispute resolution including tax litigation.

This article was originally published here on Taxpage.com. Visit www.Taxpage.com and email David at david@taxpage.com. Image by Gerd Altmann from Pixabay.

(0) Comments