Feds push carbon capture projects forward with public money

Critics say taxpayers will pay the full cost of a dubious Strathcona Resources carbon capture and sequestration project funded by the Canada Growth Fund

OTTAWA – Using taxpayer dollars, the federal government and fossil fuel companies are pushing forward carbon capture projects in Canada’s oil and gas sector.

On July 11, the federal government announced Strathcona Resources is getting a $500-million investment — with a potential increase to $1 billion — from the Canada Growth Fund to start engineering work for a carbon capture and sequestration project. The deal requires each party to fund half the cost of building the carbon capture infrastructure — $1 billion each — on Strathcona’s oilsands facilities in Saskatchewan and Alberta.

Strathcona will be able to claim back the bulk of its half of the costs through the federal government’s carbon capture investment tax credit, which was approved in mid-June. The Canada Growth Fund investments will have to be repaid, but the time frame is not clear.

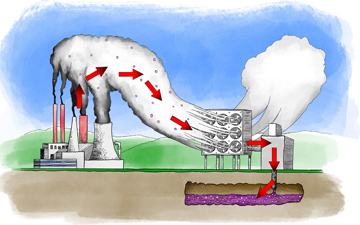

Carbon capture, utilization and storage (CCUS) — whereby climate-warming pollution is captured directly from industrial processes — is lauded by governments and industry as a key component of addressing the climate crisis and criticized by others for being a costly distraction that risks locking in fossil fuel use for decades to come.

“It is a dangerous distraction driven by the same big polluters who have caused the climate emergency,” Julia Levin, associate director of national climate for Environmental Defence, told Canada’s National Observer in a phone interview.

This situation is “especially frustrating because Strathcona has no intention of paying a single dime between getting 50 per cent of their capital costs covered by the investment tax credit and 50 per cent covered by the Canada Growth Fund,” Levin said.

“Why are taxpayers covering the full cost of one of the country's largest oil producers to continue to extract more oil?”

Strathcona Resources is Canada’s fifth largest oil producer. A final investment decision hasn’t been made yet but, if completed, Finance Canada said in a statement the project will “capture and permanently store up to two million tonnes of carbon dioxide annually,” thereby “unlocking Canada’s pathway to lead the world with low-carbon resource exports.”

Strathcona Resources did not respond to a request for comment by deadline. This story will be updated with more information when it becomes available.

Burning fossil fuels is one of the main drivers of climate change, so ending public spending that supports the industry is crucial, according to the Intergovernmental Panel on Climate Change and other expert bodies. Ending fossil fuel subsidies frees up those funds to support things like renewable energy and electrification.

Carbon capture only addresses a portion of the greenhouse gas emissions created during refining, processing and other industrial processes. It doesn’t address the impacts of burning those same fossil fuels in the tailpipe of a car, for example.

Almost one year ago, Canada announced guidelines to restrict federal subsidies to the fossil fuel sector, with numerous exceptions. The move was welcomed by environmental organizations. “Yet, they continue to break their promise by providing billions of dollars to some of the wealthiest companies in Canada,” Levin said.

Environmentalists and MPs in the Bloc Québécois, NDP and Green Party have consistently panned the federal CCUS investment tax credit as a fossil fuel subsidy. The Parliamentary Budget Officer estimated the CCUS tax credit would cost $5.7 billion over six years, but there’s no upper limit to the tax credit so the actual figure could end up higher.

Although the Canada Growth Fund loan must be repaid, it still enables financing and supports the continued production of fossil fuels, Levin said.

The lack of clarity and transparency around how the Canada Growth Fund will be repaid makes this one of the fund’s “riskiest transactions to date,” in Levin’s opinion. The $15-billion fund has been used to invest $90 million in a geothermal company and $200 million for Entropy Inc.’s carbon capture endeavours, for example. Up to $7 billion of the Canada Growth Fund’s capital is allocated for “carbon contracts for difference” to give companies certainty in case a new government repeals carbon pricing.

Historically, carbon capture technology projects have underperformed.

Shell recently announced it will go forward with Polaris, a carbon capture project at the Shell-owned Scotford refinery and chemicals complex near Edmonton, Alta. The announcement quietly lowered the amount of CO2 the project will capture by 100,000 tonnes: from 750,000 when it was announced in 2021 to 650,000.

Shell told Canada’s National Observer in an emailed statement it revised the projected capture capacity after “further engineering and design work.”

It pointed to its existing carbon capture facility, Quest, which to date, “has captured over 9 million tonnes of CO2 that would otherwise have been released into the atmosphere.”

The performance of Shell’s Quest facility has been called into question, with emissions reductions below what industry has proclaimed is possible. The company also recently came under scrutiny when it was revealed that the Alberta government struck a deal that allowed the company to sell $203 million worth of credits for greenhouse gas emission reductions that never happened.

Shell projects Polaris will “have the potential” to reduce emissions at the Scotford refinery itself by up to 40 per cent and by up to 22 per cent at the chemicals complex.

“It really just shows that these projects are not actually making a dent in emissions, but they are costing many billions of dollars,” Levin said.

Just days ago, Shell and ATCO inked an agreement with Alberta that gives the companies the right to store captured carbon dioxide deep underground in their proposed Atlas carbon storage hub. This agreement opens the door for the companies to seek the necessary regulatory approvals to advance the project.

Natasha Bulowski is a Local Journalism Initiative reporter with Canada's National Observer. With files from Senior Ottawa Reporter John Woodside. Illustration of carbon capture technology: iStock.

(0) Comments