The Accountant's Manifesto: Expecting more from Canada's financial system

In today’s fast-paced business world, why is money still moving at a snail’s pace? Every Canadian accountant knows the frustration of delayed transactions

AS ACCOUNTANTS, you understand better than anyone the financial juggling act that many businesses face. Whether it’s waiting for funds to clear or deciding which bills to prioritize, the challenge of managing cash flow is constant. If this sounds familiar, you’re not alone. These are not isolated issues — they are symptoms of a larger problem within Canada's financial system.

The numbers paint a clear picture: 98% of Canada’s 1.22 million employer businesses are small and medium enterprises (SMBs). Despite their crucial role in the economy, these businesses — many of which you manage or consult for — are not getting the support they deserve. Why? Canada’s financial system, dominated by just five major banks, has become stagnant, slow, and often unresponsive to the real needs of the businesses and accountants who keep the economy running.

You are tasked with ensuring the financial health of your clients, but you’re often working within a system that feels outdated, costly, and unnecessarily complex. You deserve better — and so do the businesses you support.

Speed: The Slow-Moving Financial System Holds You Back

In today’s fast-paced business world, why is money still moving at a snail’s pace? Every accountant knows the frustration of delayed transactions. Whether it’s payments trapped in limbo or waiting for transfers to complete, these delays disrupt cash flow, make reconciliations more difficult, and create headaches for the finance department.

How many times have you had to explain to a client that their money is tied up in “processing,” or that a payment won’t clear for days? This system isn’t just slow — it’s holding businesses back. Imagine being able to close the books faster because funds clear instantly, allowing your clients to take advantage of opportunities without delay.

Access: The Barriers to Capital Are Stifling Growth

How many of your clients have missed opportunities due to lack of access to capital? Whether it's rigid loan criteria or drawn-out approval processes, traditional banks often fall short when it comes to helping SMBs. These barriers don't just affect businesses — they impact you as their accountant, adding more work when capital is hard to come by, and complicating your role in managing cash flow forecasts and growth planning.

With financial decisions often delayed due to slow approval processes, your clients are left waiting, missing out on growth opportunities. You shouldn't have to spend time navigating these obstacles when there are more accessible options available.

Fees: High Costs for Basic Services Drain Margins

Canadian businesses pay some of the highest banking fees in the world, and as accountants, you're all too familiar with how quickly these fees add up. Whether it’s transaction fees, monthly account charges, or fees for wire transfers, these costs eat into already thin margins, making it harder for SMBs to remain profitable.

You spend countless hours trying to optimize cash flow and reduce expenses, only to see fees continue to chip away at your client’s bottom line. It shouldn’t be this hard. The financial system should work for you — not against you.

Complexity: Outdated Systems Increase Your Workload and Reduce your Growth

How much time do you spend manually reconciling accounts, chasing invoices, or dealing with outdated banking interfaces? Too much, probably. The outdated systems used by Canada's major banks create more work for accountants, whether it’s dealing with delayed transactions, manually inputting data from multiple platforms, or navigating labyrinthine processes to access simple financial information.

This complexity is a hidden tax on your time, energy, and resources — time that could be better spent furthering your personal and professional growth through strategic financial planning, client advisory services, or improving your firm’s efficiency.

The Path Forward: Expect More from Your Financial System

Accountants are often the unsung heroes of the business world, working behind the scenes to ensure financial health, compliance, and profitability. But for too long, you’ve been forced to operate within a financial system that isn’t designed with you in mind.

It’s time to expect more.

Innovation has transformed many industries, and it's time that it reaches your finance department. You deserve a system that works as hard as you do, one that moves at the pace of business, reduces unnecessary costs, and simplifies your day-to-day operations. Canada’s financial system may be slow to evolve, but many fintech companies are leading the charge toward a better future. Offering tools that move at the speed of business, allowing money to flow quickly and easily, real-time business data to make decisions, and lower-cost alternatives to traditional banking services — this is the support Float believes businesses deserve.

By embracing these innovations, you can transform the way you manage finances and unlock new opportunities for your clients.

The time for change is now. The tools are out there. It’s time for innovation to hit the finance department.

|

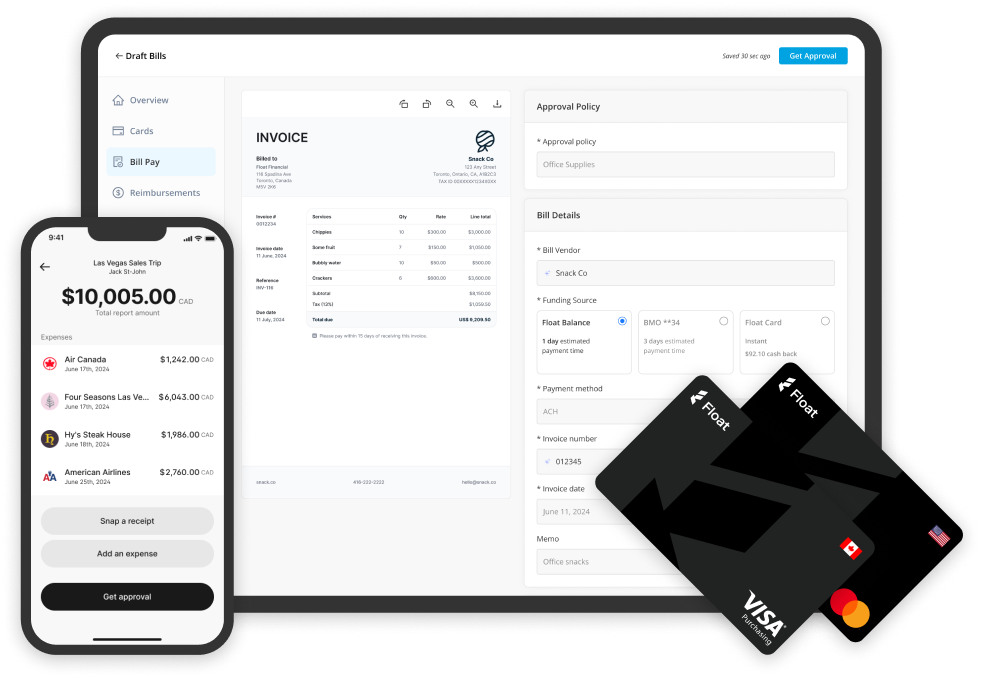

Float business finance platform from floatfinancial.com. CLICK ON IMAGE TO ENLARGE. |

Join the Movement with Float

At Float, we're not sitting around waiting for government reforms, open banking policies, or traditional banks to evolve - and you shouldn’t either. Don’t settle for the status quo—demand more from your banks, expect better tools, and leverage the power of fintech to make your job easier and more effective.

Float is a modern business finance platform designed to simplify and streamline your financial operations. By automating manual month-end processes and reducing time-consuming tasks, Float helps free up your time for higher-value activities: www.floatfinancial.com.

This partner post is an advertising feature produced by Float.

(0) Comments