Practice

Thought Leaders

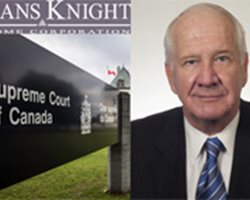

Deans Knight: The return of the GAAR

The Supreme Court of Canada's decision in Deans Knight is a breath of fresh air and strikes a more appropriate balance, says Allan Lanthier

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Burden of proof for misrepresentation in tax reassessments is high — and rests with the CRA

In a recent Tax Court of Canada case, the Canada Revenue Agency's proof was flimsy, says Canadian accountant and tax lawyer David J Rotfleisch

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

US banking failures: the role of big auditors in another financial crisis

A state auditor would be better than accounting firms at policing systemically important institutions such as banks

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 23.05.28: The Deans Knight Rises, Big Four soaps, and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Special Report: Foreign accounting firms dominated Canadian mid-tiers in 2022 and the audit regulator is concerned

Audit firms based in the United States made the most net client gains in the Canadian mid-tier accounting sector, according to data compiled by Audit Analytics

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

GST/HST tax fraud is a ‘special operation' at the Canada Revenue Agency

It involves fraudulent refund claims, fake invoicing, and GST/HST evasion through off-the-books cash sales, explains tax lawyer and accountant David J. Rotfleisch

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Special Report: KPMG Canada beats Big Four accounting rivals in net new client gains

But Ernst and Young Canada was the real winner in new audit engagements in 2022, according to data compiled by Audit Analytics

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 23.05.14: CPAB historic disclosure, PwC Oz, and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Vancouver accounting firm Smythe LLP first Canadian audit firm to be publicly censured by regulator under new disclosure rules

Changes to enforcement disclosure rules by CPAB means more transparency from audit regulator, more public scrutiny of Canadian auditors

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Why the Canada Revenue Agency tax workers strike was good for Canadian accountants

All sides will benefit from the tentative settlement and four years of labour peace. But technology investment is mitigating the impact of CRA strikes

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

The Alternative Minimum Tax Goes Mainstream

Stephen Bowman and John (Jay) Winters of Bennett Jones present a capital gains case study on the impact to taxpayers of changes to the AMT regime

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 23.04.30: Tax Deadline Day to pass despite CRA strike and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160