2021 updates for T1134: A Canadian tax lawyer's perspective

The T1134 has been updated to reflect legislation changes that allow the CRA to collect additional information and provide some reporting relief

What is the T1134?

|

David J Rotfleisch, CPA, CA, JD, is the founding tax lawyer of Rotfleisch & Samulovitch P.C., a Toronto-based boutique tax law firm. |

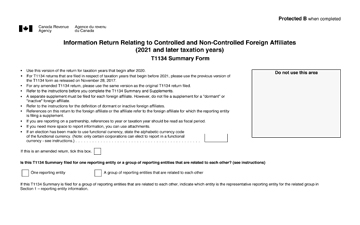

The T1134 form is an informational reporting requirement for Canadian taxpayers. Using the T1134, Canadian taxpayers are required to provide certain information about foreign affiliates the taxpayer owns an interest in. The party filing the T1134 is called a "reporting entity." A foreign affiliate is defined as any foreign corporation in which the reporting entity owns at least a 1% equity interest, and in which the reporting entity and related persons own a combined 10% or greater equity. The T1134 form must be filed on an annual basis by each reporting entity meeting the filing requirements. The T1134 form does not directly result in the assessment of any taxes payable, but failing to file the form can result in penalties and interest on those penalties.

For more information on the T1134, see T1134 Canadian Income Tax Form.

What are the changes for the T1134?

Starting in the 2021 taxation year and onward, the T1134 received an update to reflect legislation changes, that allow the Canada Revenue Agency to collect additional information and provide some reporting relief. The following is a non-exhaustive list of the changes.

Information Reported

The new T1134 form is about double the length of the old form as it requires additional disclosure. The new information which must be disclosed includes:

- Gross revenue must now be broken down to indicate whether the source is arm's length or non-arm's length.

- Additional information must be given concerning employees

- Upstream loans, that being the Canadian taxpayer being indebted to the foreign affiliate, may need to be disclosed.

- The adjusted cost base of common and preferred shares as well as changes in the adjusted cost base during the year must be disclosed.

- Additional disclosure is required for Foreign Accrual Property Income (FAPI), Foreign Accrual Property Losses (FAPL), Foreign Accrual Capital Loss (FACL) and Foreign Affiliate Dumping (FAD).

Relieving Changes

- An organization chart can now be provided in place of responding to the organizational structure questions.

- Unconsolidated financial statements of foreign affiliates only need to be provided for foreign affiliates in which the reporting entity directly or indirectly owns 20% of the voting shares or where the "tracking arrangement" rules deems the reporting entity to have a tracking interest in a foreign affiliate.

- Information such as book cost of shares of lower-tiered corporations, total assets and certain other financial data no longer needs to be disclosed.

- Employees no longer need to be reported on a business-by-business basis.

Dormant Foreign Affiliates

Formerly, reporting entities with an aggregate cost amount to the reporting entity of his/her/its interest in all of the foreign affiliates of the reporting entity was less than $100,000 CAD did not need to report dormant foreign affiliates on the T1134 form. Starting with the 2021 taxation year and onward, these reporting entities will need to list dormant foreign affiliates on the T1134 form. However, these reporting entities do not need to file a T1134 Supplement for dormant foreign affiliates.

As relief for this additional reporting requirement, the dormant foreign affiliate definition has been updated to qualify more foreign affiliates as "dormant." A dormant foreign affiliate is now:

- Had gross receipts in the year (including proceeds from the disposition of property) of less than $100,000 CAD, and

- At no time in the year had assets with a total fair market value of more than $1,000,000 CAD.

The information portion of form T1134 explains that the term "gross receipts" means "any receipt received in the year" and "includes all non-revenue receipts, such as loans, etc."

Joint Filing

To ease the reporting burden, the Canada Revenue Agency has introduced a limited allowance for joint filing. A group of reporting entities who are related to each other, share the same tax-year end and report in the same currency can jointly file their T1134. The reporting entities must report in Canadian dollars or a functional currency.

Deadline to File

For 2021 and onward, the T1134 must be filed within 10 months of the end of the reporting entity's taxation year.

Penalties

Under the new T1134 form, a taxpayer incurs penalties where the reporting entity either fails to file the T1134 or files the T1134 form but with false and/or incomplete information. This is a change from the previous T1134 form where only failing to file the form would result in penalties. A reporting entity who files an incomplete T1134 form can be exempted from penalties where the reporting entity has exercised the requisite due diligence to obtain the missing information, disclosed on the T1134 form that the information was missing, it was reasonable to expect sufficient information would be given to the person or partnership about any transaction which impacts filing requirements and the reporting entity files an amendment to the T1134 with the missing information within 90 days of the information becoming available.

Pro Tax Tips: T1134 and Voluntary Disclosure Program

The Voluntary Disclosure Program allows taxpayers to proactively correct any errors in their tax filing in exchange for potential penalty and interest relief. Taxpayers using this program to correct their previously filed tax information and returns should use the filing requirements for the tax year which was previously erroneously filed.

For example, if a taxpayer neglected to file the T1134 in 2019 and was using the voluntary disclosure program to correct that error, the taxpayer must provide unconsolidated financial statements for all foreign affiliates as the 20% shareholding exemption discussed above did not apply in 2019. A voluntary disclosure application can only be filed where the errors being corrected involve a period at least one year past due.

David J Rotfleisch, CPA, CA, JD, is the founding tax lawyer of Rotfleisch & Samulovitch P.C., a Toronto-based boutique tax law firm. He appears regularly in print, radio and TV. With over 30 years of experience as both a lawyer and chartered professional accountant, he has helped start-up businesses, resident and non-resident business owners and corporations with their tax planning, with will and estate planning, voluntary disclosures and tax dispute resolution including tax litigation in Tax Court and the Federal Court. Visit www.Taxpage.com and email David at david@taxpage.com. Read the original article on Taxpage.com.

(0) Comments