Canada Revenue Agency raids three companies in connection to Panama Papers

Early morning raids conducted in connection to Panamanian law firm Mossack Fonseca, two years after data leak

Breaking news. Story to be updated.

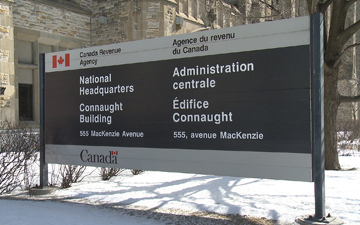

TORONTO, February 14, 2018 – The Canada Revenue Agency (CRA) announced that it executed three search warrants on February 14, 2018, during the course of an offshore tax evasion criminal investigation related to the data leak from the Panamanian law firm and corporate service provider Mossack Fonseca, made public in the Panama Papers.

Approximately 30 CRA criminal investigators, assisted by members of the RCMP and the West Vancouver Police, took part in the operation that unfolded in Calgary, West Vancouver and the Greater Toronto Area, searching for evidence with respect to the commission of offences against the Income Tax Act and the Excise Tax Act. The CRA’s investigation identified a series of transactions involving foreign corporations and several transfers through offshore bank accounts used allegedly to evade taxes.

Working in collaboration with its domestic and international partners, the CRA would like to acknowledge the significant contribution of the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) to this criminal investigation.

This investigation is one of the 42 international/offshore tax evasion cases that CRA is currently investigating which involve complex structures and potentially multi-million dollars in taxes evaded, which is consistent with our priority of focussing on sophisticated and well organized tax evasion schemes.

The Agency is pursuing additional criminal investigations relating to the Panama Papers data leak.

Wilfully failing to follow tax laws could result in serious consequences, including reassessments, the imposition of civil penalties and criminal tax investigations and prosecutions resulting in the imposition of court fines, jail time and a criminal record. Under the income tax and excise tax laws, persons convicted of tax evasion can face fines ranging from 50% to 200% of the evaded taxes and up to five years imprisonment. If convicted of fraud under Section 380 of the Criminal Code, an individual can face up to 14 years in jail.

Colin Ellis is the managing editor of Canadian Accountant.

(0) Comments