Thoughts on the CRA and Canadian corporate tax gap

Are the numbers to be trusted? asks David J. Rotfleisch

TORONTO – The Canada Revenue Agency recently published the corporate tax gap estimates, approximately one year following the publication of personal international income tax gap information.

The tax gap is an estimate, long requested by the Honourable Senator Downe, between the taxes that would be paid if all taxes properly owing were paid by taxpayers, and the tax actually paid and collected by CRA. In other words, the tax gap is an estimate of tax revenue loss, or shortfall, resulting from intentional and unintentional tax non-compliance which can occur at the time of filing, reporting or paying taxes.

The current report examines the corporate income tax gap related to incorporated small and medium-sized enterprises (SMEs) and large corporations. Let me quote from the report:

For the SME population, random audit results conducted by the CRA are leveraged to estimate the federal tax gap for tax year 2014. Based on the results from these random audits, the federal tax gap in 2014 is estimated to be between $2.7 billion and $3.5 billion for SMEs before considering any audit results or between 7% and 9% of overall federal corporate income tax revenue. It is important to reiterate that these tax gap estimates do not reflect the CRA's audit activities that reduce reporting non-compliance. Assuming audit results for tax year 2014 are similar to a prior year audits are expected to reduce the tax gap by $1.1 billion in federal tax or by 31% to 40%. This represents between 4% and 6% of overall federal corporate tax revenue in 2014.

There’s a lot of information to digest in that paragraph, but there are some key takeaways.

Information is based on tax audits carried out and projected to the total SME population. This estimated tax gap is then reduced by CRA audit results. Makes sense, doesn’t it? Unless you actually have experience with CRA auditors and audits.

Canadian tax accountants and lawyers know that CRA auditors are just plain wrong far too often. This was acknowledged by the Auditor General, Michael Ferguson, who released his report on the tax compliance efforts of CRA on September 18, 2018. His second finding was that CRA couldn’t accurately measure, and therefore didn’t accurately report, its performance. In particular, the report stated that CRA overstated the revenue it generated by failing to account for taxes that were still under dispute and uncollectable or tax debts that were written off.

A tax gap analysis, while providing extremely useful information as to the effectiveness of Canada’s tax collection efforts, is of necessity a very crude estimation. However, to base the SME portion of that analysis on a known flawed process begs the question of, why even bother?

The federal tax gap for incorporated SMEs was between $2.7 billion and $3.5 billion for tax year 2014 before considering any audit results. However the lion’s share of the tax gap belongs to large corporations and is estimated to be between $6.7 billion and $7.9 billion for tax year 2014 before considering any audit results. So let’s turn to the methodology for large corporations.

The CRA applied a statistical approach, commonly referred to as the extreme value methodology, to estimate the large corporate tax gap using risk-based audit results. This approach was selected because it has been employed in the U.S. to estimate its corporate income tax gap. The extreme value methodology relies on the assumption that audit adjustments among large corporations follow a distribution where the majority of tax non-compliance in the large corporate population is concentrated in a relatively small number of corporations. An analysis is then performed to extrapolate tax non-compliance to the unaudited portion of the large corporation population.

A second statistical method, cluster analysis, was also used. It refers to an unsupervised machine learning technique in the field of artificial intelligence that is used for identifying subgroups or "clusters" in a population, where elements within a cluster are more similar to each other than to those in other clusters.

In the context of tax gap analysis, a clustering technique was used to assign large corporations into relatively distinct clusters on the basis of their characteristics in order to estimate the potential level of non-compliance within each cluster. This method is similar to the post-stratification method used by the Italian Revenue Agency to estimate its corporate tax gap.

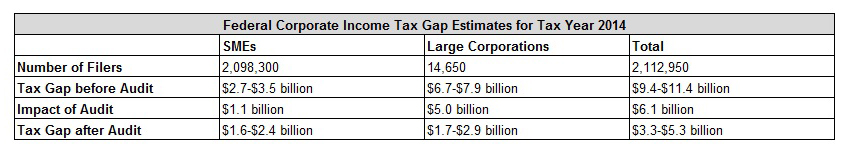

Not being a statistician, I really cannot analyze the effectiveness of this methodology. But I take comfort in the fact that it does not rely upon known flaws in the CRA system. However, the bottom line after audit numbers reported by CRA relies on audit results which are known to be flawed. The table below sets out the final estimates.

By way of comparison, the IRS estimates that, between tax years 2008 and 2010, the U.S. had an annual gross tax gap of $504 billion, and an annual net tax gap of $447 billion, in 2016 dollars. However, the corporate component of that tax gap was only $44 billion. With the general rule of thumb that the U.S. is 10 times the size of Canada it appears that the Canadian tax gap numbers are in the right range based on the U.S. numbers.

David J Rotfleisch, CPA, JD, is the founding tax lawyer of Rotfleisch & Samulovitch P.C., a Toronto-based boutique tax law firm. With over 30 years of experience as both a lawyer and chartered professional accountant, he has helped start-up businesses, resident and non-resident business owners and corporations with their tax planning, with will and estate planning, voluntary disclosures and tax dispute resolution including tax litigation. Visit www.Taxpage.com and email David at david@taxpage.com.

(0) Comments