Why taxpayers cannot rely on advice from the CRA

Taxpayer reassessed for acting on information given to him by the CRA

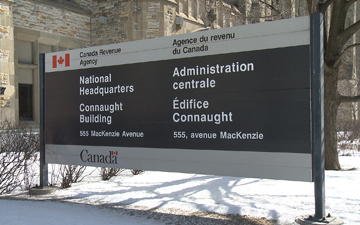

TORONTO – It should come as no surprise to anyone who has ever regularly dealt with the Canadian Revenue Agency that the CRA isn't always right when it comes to tax law. That's why the Tax Court of Canada exists. However, in cases where a taxpayer relies on incorrect information provided by the CRA to detrimental consequences, one would think that that taxpayer would be able to obtain some relief from the courts or the CRA.

However, this is not always the case, as the taxpayer in the recent case of 2237065 Ontario Inc. v. The Queen found out. For the tax years of 2011 and 2012, the taxpayer was a truck driver incorporated as an Ontario numbered corporation per his employer requirements. He was advised by his employer that his services were zero-rated and thus he would be exempt from having to collect GST/HST taxes. To confirm this, the taxpayer called the CRA and asked whether he had to collect HST where his employer was in turn not collecting HST from him. The CRA advised him that he did not, and the taxpayer relied on this information.

In 2016, however, the CRA issued reassessments to the taxpayer for his 2011 to 2014 tax years for HST under Part IV of the Excise Tax Act. The taxpayer appealed for the years of 2011 and 2012 to the Tax Court, but the appeal was dismissed. For the tax periods in question, the taxpayer was found to have been providing "driving services" rather than "freight transportation services," as defined in subsection 1(1) of Part VII, Schedule VI of the Excise Tax Act. As such he was deemed not a carrier as defined in subsection 123(1) and his services were not zero-rated.

The taxpayer argued that he relied on incorrect advice given to him by CRA officers and was therefore entitled to some relief. In short, he was making an argument similar to estoppel. Estoppel is a legal doctrine that may prevent, or "estop" a person acting on a certain set of rights in a manner contrary to representations made to another party, to which that party acted in reliance to their detriment. For example, if a landlord told his tenant that he was not required to pay rent "until the war is over," the landlord could be estopped from claiming rent throughout the period promised. In this case, however, the court rejected this argument on the basis that it could not allow itself to be bound by the CRA's interpretation or representation of the law.

No relief for taxpayers when it comes to matters of law

|

David J. Rotfleisch, CPA, JD, is the founding tax lawyer of Rotfleisch & Samulovitch P.C. |

This was not the first case in which a taxpayer had detrimentally relied on advice given by the CRA only to be hit by reassessments years later without any relief. In both the 2015 case of Grondin v. The Queen and the 2002 case of Moulton v. The Queen, the court consistently held the position that it would not be bound by erroneous departmental interpretations of the CRA.

While it may be shocking and perhaps even unfair to taxpayers that the CRA can provide incorrect tax advice to taxpayers and then reassess them later for having acted on said advice to their detriment, the tax court's reasons for refusing to grant relief in this case is obvious. The CRA gets tax law wrong all too often. If the court allowed itself to be bound by the CRA's personal interpretation of the law or by all the representations it makes to taxpayers on a daily basis, there would not be much consistency in this field of law. In this case, because the issue was a matter of law, the court had no basis for granting relief and the appeal was dismissed without costs.

When can tax relief be granted?

While the Tax Court cannot grant relief when it comes to the interpretation of the law itself, subsection 220(3.1) of the Income Tax Act does allow taxpayers to apply for relief from penalties and from interest from the CRA. Per CRA policy, Information Circular IC 07-1, "Taxpayer Relief Provisions," specifically states that interest and penalties may be waived where there are errors in CRA materials that are available to the public and information provided to the taxpayer.

This abridged article was originally published in full on Mondaq. David J. Rotfleisch, CPA, CA, JD, is the founding Canadian tax lawyer of Rotfleisch & Samulovitch, P.C., a Toronto-based boutique income tax law firm (Taxpage.com). With over 30 years of experience as both a lawyer and chartered professional accountant, he has helped start-up businesses, resident and non-resident business owners and corporations with their tax planning, with will and estate planning, voluntary disclosures and tax dispute resolution including tax litigation. Contact David at david@taxpage.com.

(0) Comments