As inflation looms, here’s how real estate and farmland have protected investors

Canadian real estate and farmland have been historical inflation hedges

|

Grant Alexander Wilson is a faculty member in the department of management & marketing at the Edwards School of Business, University of Saskatchewan. |

SASKATOON – More than 100 years ago, a jug of milk was 40 cents. Today, it’s almost $4. This phenomenon is called inflation.

Over the past five decades, all industrialized nations have experienced inflation. A typical rate of inflation is around two per cent and indicates a stable economy.

Although Murray Rothbard, a 20th-century economic historian and political theorist, argues that the natural tendency of the state is inflation, it has its drawbacks. For example, if prices increase too fast, you lose purchasing power. To this end, Milton Friedman, a Nobel Prize-winning economist, observed that inflation is taxation without legislation.

Inflation in Canada

Although inflation in Canada has been historically stable, it can never be fully anticipated. The COVID-19 pandemic has created unprecedented market uncertainty and economic anomalies.

According to the latest Statistics Canada data, the year-over-year inflation rate was 0.7 per cent. Some experts are suggesting that inflation is currently underestimated. Demand for essential goods and services is high, as their prices are tracking above average. Yet the current “basket of goods” in Canada’s consumer price index — used to assess inflation — includes many non-essential categories that did not appreciate in the last year.

Therefore, current measures may need to be reconsidered to accurately reflect Canada’s inflation.

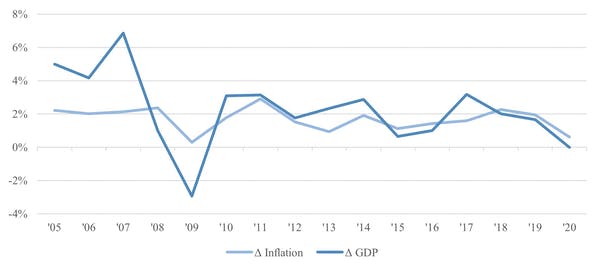

The much-anticipated end to COVID-19 and Canada’s stimulus package further point to long-term inflation. As economies emerge from recessions and gross domestic product (GDP) rises, inflation occurs.

Historically, Canada’s inflation has followed, but lagged, its GDP increases. Accordingly, post-pandemic GDP gains are likely to be a driver of inflation. The unparalleled COVID-19 stimulus package, 420 per cent larger than Canada’s 2008 recession stimulus package, is also likely to create inflationary trends.

|

Inflation and GDP. (Macrotrends, Statista, Author's calculations), Author provided. |

Hedge against inflation

To individuals, losing purchasing power as a result of inflation is perhaps the most salient feature of increasing prices. Anticipating those increases, prudent investors explore ways to hedge against inflation.

An inflation hedge involves investing in an asset that is expected to maintain or appreciate in an inflationary period. Hopefully, its appreciation exceeds, or is at least comparable to, inflation. Real estate has long been considered a hedge against inflation, as rent and property values tend to increase with inflation. Historical empirical evidence supports real estate and farmland as effective inflation hedges.

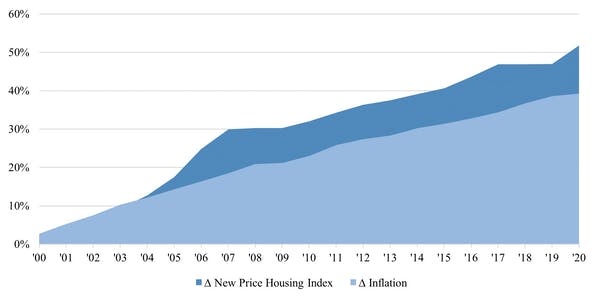

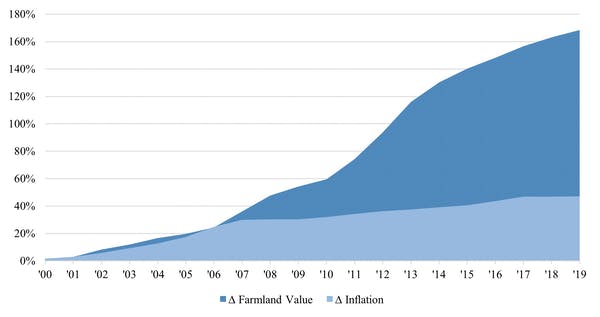

In order to explore the historical effectiveness of Canada’s real estate and farmland as an investment hedge, I compared inflation to the new housing price index and farmland values from 2000 to 2020.

I selected the new housing price index as a proxy for property appreciation because it’s the most timely indicator of changes to residential real estate values. Farmland values obtained from Farm Credit Canada were used to determine its appreciation.

|

Cumulative change in inflation and the new housing price index. (Statista, Statistics Canada), Author provided. |

From 2000 to 2020, the cumulative inflation change was 39 per cent compared to a change and increase of 51.8 per cent to the new housing price index. The data showed that the new price housing index tracked above inflation.

From 2000 to 2020, the cumulative farmland value appreciation was 168.4 per cent. The data showed that Canadian farmland significantly outpaced inflation.

|

Cumulative change in inflation and farmland value. (Statista, Farm Credits Canada, author's calculations), Author provided. |

Based on this 20-year period, it’s evident that residential real estate and farmland values appreciated faster than inflation, suggesting both were effective hedges against inflation.

Looking to the past to predict the future

Accordingly, anticipating a period of inflation, savvy investors are significantly expanding their real estate portfolios. Although rising prices, let alone investments, can never be fully anticipated, the best known predictor of the future is the past.

Macroeconomics trends, including the COVID-19 stimulus package, expected GDP gains and anticipated reduction in unemployment, suggest inflation is on the horizon in Canada.

In these extraordinarily uncertain times, prudent investors seek to protect the value of their money. Previously, Canadian residential real estate and farmland have proved to be strategic inflation hedges.

After all, as billionaire industrialist Andrew Carnegie once stated:

“Ninety per cent of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined.”

Grant Alexander Wilson is a faculty member in the department of management & marketing at the Edwards School of Business, University of Saskatchewan. Photo by Pascal Bernardon on Unsplash.

(0) Comments