Alternative federal budget 2026: Taxation

As the Carney government prepares to unveil its budget on Tuesday, the Canadian Centre for Policy Alternatives has presented its Alternative Federal Budget

Introduction

Unfortunately, new federal government policies are taking us backwards on tax fairness. The government recently eliminated the consumer carbon tax, which returned more money to most low-income families than they paid.[1] A few days later, it cancelled the partial closure of the capital gains loophole, one of the features of our tax system that most benefits the ultra-wealthy. The first bill the new government introduced lowered the marginal tax rate on the first income bracket, which returns more dollars to higher-income earners than to lower-income earners.[2]

Transferring more money to the wealthy will not solve the multiple, intersecting crises Canada faces. We will need a collective approach to use available resources to fund a green transition and affordable housing. Getting this done is not a matter of feasibility — it’s just a matter of political will. Billionaire wealth in Canada increased by $309 million every day in 2024.[3] Because of myriad loopholes and tax planning mechanisms, increasing billionaire wealth is typically taxed at a lower rate than the income of an average earner in Canada. When all taxes are considered, the top one per cent of earners paid 23.6 per cent of their income in tax in 2022, while the average earner paid 36.7 per cent of their income in tax.[4]

The outcome of a system that increasingly concentrates income, wealth and power among a select few can be seen south of the border right now. Canadians made clear in the 2025 federal election that they do not want to go down that path. Building a sustainable democratic society in which we can all thrive will require mobilizing Canada’s vast resources. The tax system is a powerful tool that can be used to free up Canada’s resources to fund the important projects laid out in the rest of this platform.

Overview

The cost of living crisis that followed the COVID-19 pandemic revealed the enormous power that large corporations have over the rest of us through their price-setting power. They used input price increases as cover to increase their profits to never-before-seen levels.[5] Through their ownership of large corporations, this led to an explosion in the wealth of billionaires. Even as inflation has slowed, corporate profits and billionaire wealth have remained well above pre-pandemic levels.

The tax system can act as a powerful tool to incentivize the private sector to act. Unfortunately, the tax system is currently sending the wrong signals. Measures like subsidies for fossil fuel extraction and tax breaks for real estate investment trusts encourage increased carbon emissions and the financialization of housing.

Actions

The AFB will create a new personal income tax bracket on income above $1,000,000. During the mid-20th century, Canada had top marginal tax rates over 80 per cent for extremely high income. The purpose of such rates is not just to raise revenue, it is to discourage incomes from being so high. In 1971, the marginal tax rate on income over $400,000 ($3.16 million in today’s dollars) was 82.4 per cent.[6]

This rate would have applied to less than 0.01 per cent of taxpayers because it effectively discouraged such outrageous incomes. Today, the top personal income tax bracket, with rates of 44.5-54.8 per cent across provinces and territories, applies to two per cent of taxfilers. A new federal income tax bracket with a rate of 37 per cent on income over $1,000,000 would affect only 43,000 people, or 0.135 per cent of taxfilers, deterring outsized salaries and raising $1.5 billion in 2025.

The AFB will tax extreme wealth. Since wealth tends to grow faster than the economy, wealth and power can become more concentrated in the hands of a few. Currently, the 20 richest Canadians have over $239 billion in wealth, equivalent to over 10 per cent of Canada’s GDP.[7] This level of wealth concentration gives individuals outsized influence over our society. A progressive wealth tax on net worth over $10 million would redistribute wealth and power, while raising over $37 billion in the first year[8]; 99.4 per cent of Canadians would not be affected by this tax.

The AFB will prevent corporate profiteering during crises. The AFB will implement a permanent windfall profits tax, triggerable during social and economic crises, on taxable profits above 120 per cent of pre-crisis profit levels. This would disincentivize corporations from jacking up prices to inflate their profits during crises. A mechanism like this would have raised $50 billion from 2021-23, although, if effective, it would have raised less revenue but limited inflation.

The AFB will make the corporate income tax system more progressive. Individuals who earn larger employment income pay a higher marginal income tax rate — why don’t corporations? Initial corporate income taxes in the U.S. did have graduated rates, and this system still exists, to a limited extent, through the small business deduction.[8]

In addition to raising more revenue from those with a greater ability to pay, graduated corporate income tax rates can act as an antitrust measure, discouraging corporate consolidation. Corporate consolidation has increased firms’ price-setting power, one of the driving factors of the recent bout of inflation[9].

To combat this, the AFB proposes a super-profits tax of five per cent on corporations with taxable income over $100 million on a consolidated basis.[10]

The AFB would also increase the general federal corporate income tax rate from 15 per cent to 20 per cent, partially offsetting the corporate income tax cuts that took place between 2007 and 2012. These cuts gutted public revenue without spurring investment, which remains below 2012 levels.[12] These measures would raise $23 billion in revenue annually.

The AFB will eliminate the dividend tax credit (DTC). This credit reduces the tax rate on dividends, meaning that investors pay a lower tax rate on their income than workers. In theory, the DTC prevents double taxation but it “is essentially a windfall for the investors who own eligible stocks”.[13] It also incentivizes firms to use cash to pay investors instead of re-investing in productive capital. This tax break is regressive, since a full one third of dividends are received by the top one per cent of income earners.[14] Eliminating this credit could raise $7.8 billion per year.[15]

The AFB will implement a minimum tax on book profits (profits that corporations report to their shareholders, which are typically larger than taxable profits because of a wide range of tax avoidance strategies). This tax will ensure large corporations cannot combine loopholes to eliminate their tax burden. Canada already has a similar tax for individuals (alternative minimum tax) and the United States implemented such a tax in 2023. A book profits tax of 21 per cent would bring in over $5.4 billion in revenue per year.

The AFB will prohibit the use of tax havens by large corporations and the wealthy to avoid taxes. The Tax Justice Network estimates that corporate tax abuse and failure to declare offshore wealth costs Canada $15 billion annually.[16] The implementation of the Global Minimum Tax Act is a welcome step but falls far short of addressing this problem.[17]

The 15 per cent minimum tax rate still provides a huge incentive for profit shifting, and the carve outs for real economic activity and tax credits further encourage the race to the bottom. To ensure corporations pay their fair share of taxes, the AFB will end the tax agreements with tax havens that incentivize profit-shifting, it will require corporations to provide a genuine business reason for setting up offshore subsidiaries, it will subject all corporate entities to the minimum book profits tax of 21 per cent, and it will make corporate country-by-country financial information public—92 per cent of Canadians support measures to prevent the use of tax havens.[18] These measures could raise $14 billion in revenue per year.

The AFB will fund the Canada Revenue Agency (CRA) to crack down on tax avoidance by the wealthy and large corporations. The Parliamentary Budget Office (PBO) estimates a payback of $4-5 for every extra dollar invested in business tax compliance.[18] Increasing the budget of the CRA would allow workers to investigate the complex international schemes devised for corporations and wealthy tax avoiders. Therefore, the AFB will invest an extra $2 billion over three years in the agency.

The AFB will provide the CRA with $25 million per year to support the charitable sector in a way that ensures tax-exempted dollars benefit the public, while protecting against possible individual harms and damaging labour force implications resulting from recent regulatory changes. In December 2023, the CRA released its final policy guidelines on making grants to non-qualified donees. Content in the newly revised CRA Charities Directorate’s T3010 Form points to some troubling possibilities, as it makes clear the ability for charities to provide funding to for-profits to deliver education and health care programs. Other jurisdictions with similar regulatory allowances show a common practice of large, for-profit corporations receiving tax-exempted dollars. The tax implications for individuals receiving gifts, and how the new legislation interacts with employment status, are areas of concern. In 2023, around $729 million were disbursed to non-qualified donees.[20]

As the CRA only requires reporting for grants over $5,000, there is approximately $127 million that was disbursed to 38,297 grantees with no public reporting accessible. While these regulatory changes have been described as the most significant the charitable sector has seen in decades, the CRA does not appear to have the requisite resources to monitor unintended harms. Additional CRA staff would provide proactive support to charities and would-be grantees to help them navigate these new regulations, reducing the possibilities of abuse or unintended harms, is a critical investment. The CRA also requires specific capacity to analyze the impacts of this regime in relation to employment, taxation, and privatization.

The AFB will revert to the 2023 alternative minimum tax (AMT) proposal, reaffirming the government’s commitment to a progressive tax policy. According to the House of Commons Standing Committee on Finance, “from a global perspective, Canada provides the most generous tax support for charitable donations by individuals."[21]

To address this, the Government of Canada’s 2023 budget introduced a transformative update to the AMT, aimed at ensuring that high-income individuals and trusts contribute a fairer share to the national tax base. Under the proposed revised AMT, only 50 per cent of the value of charitable donation tax credits can be claimed when calculating AMT liability, down from 100 per cent under the current tax system. This change ensures that high-income earners cannot use large charitable donations to eliminate their tax obligations entirely, while still preserving a meaningful incentive for philanthropy. In response to feedback from parts of the charitable sector, budget 2024 increased the inclusion rate for charitable donation tax credits from the initially proposed 50 per cent to 80 per cent.The original budget 2023 proposal strikes a balance by continuing to incentivize charitable donations, while also serving as a tool to address wealth inequality and generate public revenue.

The AFB will eliminate all subsidies and financing for the fossil fuel sector. Environmental Defence estimates that the Government of Canada provided nearly $30 billion in financing and subsidies to the oil and gas industry in 2024.[22]

Quietly, the government abandoned its modest pledge to eliminate “inefficient” fossil fuel subsidies by extending tax credits for the oil and gas industry in the 2024 fall economic statement. The AFB will stop providing any public funding to this sector, which contributes more to Canada’s carbon emissions than any other sector.[23] (See the Environment and climate change chapter for how the AFB would change the carbon pricing system.)

The AFB will undertake a comprehensive review of federal tax expenditures for corporations. Giving money directly to corporations through tax credits has become government’s de facto response to problems from climate change to depressed business investment to skyrocketing housing prices. Despite the tens of billions in lost revenue,[24] there is no evidence that these corporate giveaways have contributed to solving any of these pressing problems.

The AFB would cancel the renewal of the accelerated investment incentive, the new AI tax credit and the expansion of mining tax credits, saving over $2.5 billion annually.[25] Tax credits for clean energy would be maintained but be subject to strict labour and community benefit conditions that required corporations to pay sufficient wages, have high labour standards, and ensure investments met the needs of local communities.

The AFB will close the REIT tax loophole. Real Estate Investment Trusts (REITs), a type of financialized landlord, are not subject to corporate income tax, supposedly to incentivize real estate investment. However, REITs are more likely to acquire existing stock than to build new housing stock. Moreover, financialized landlords like REITs charge higher rents than any other type of landlord.[26] Rather than ensuring new supply is built, this tax loophole ensures more housing is owned by financial investors who prioritize investors’ returns over providing affordable housing. Improving housing affordability will require reducing investor demand for housing. Eliminating this loophole would bring in at least $59 million per year in net revenue (see the Affordable housing chapter).[27]

The AFB will eliminate the First Home Savings Account. This policy will do little to increase housing affordability and may even lead to further increases in housing prices. Eliminating this ill-advised measure will save the federal government $595 million.[28]

The AFB will end tax deductibility for foreign internet advertising. The Canadian media ecosystem is in crisis. Local media is disappearing, being replaced by foreign internet giants. Currently, advertising on foreign internet media is tax deductible, incentivizing companies to shift their advertising to foreign media platforms—furthering the collapse of Canadian media. Advertising on foreign newspaper and broadcast media is already not tax deductible, and this tax treatment should be extended to foreign internet media. This could raise $400 million annually in additional corporate income tax revenue.[29]

|

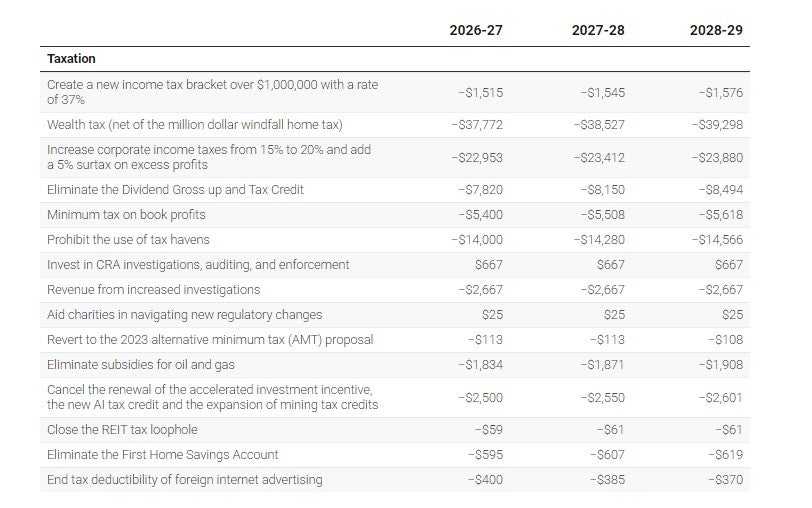

CCPA AFB actions, all figures in $millions. Click on chart to enlarge. Click here to read the original article and access the data.

|

FOOTNOTES

[1] Parliamentary Budget Officer, “A distributional analysis of the federal fuel charge—update,” October 10, 2024.

[2] David Macdonald, “Platform Crunch 2: Comparing four parties’ tax cut and cash transfers promises,” Canadian Centre for Policy Alternatives, March 28, 2025.

[3] Oxfam Canada, “Billionaire wealth surges by $2.8T in 2024, poverty unchanged since 1990,” January 20, 2025.

[4] Marc Lee and DT Cochrane, “Canada’s shift to a more regressive tax system, 2004 to 2022,” Canadian Centre for Policy Alternatives, April 2024.

[5] Jim Stanford, “Canadian corporate profits remain elevated despite economic slowdown,” Centre for Future Work, February 2024.

[6] E.J. Benson, “Summary of 1971 tax reform legislation,” Government of Canada, 1971.

[7] Calculated from Forbes, “The world’s real-time billionaires,” Forbes, retrieved June 16, 2025.

[8] Alex Hemingway, “A wealth tax could raise half a trillion dollars for a stronger, fairer Canada,” BC Society for Policy Solutions, June 4, 2025.

[9] Reuven Avi-Yonah, “Corporate taxation to curb monopoly power: a brief history and a proposal,” Tax Justice Network, November 2, 2022.

[10] Weber, Isabella M., and Evan Wasner, “Sellers’ inflation, profits and conflict: why can large firms hike prices in an emergency?,” Review of Keynesian Economics 11(2), 2023: 183-213.

[11] Silas Xuereb, “Taxing excess profits in Canada: An urgent proposal for action,” Canadians for Tax Fairness, November 25, 2024.

[12] Statistics Canada, “Table 33-10-0225-01: Quarterly balance sheet, income statement and selected financial ratios, by non-financial industries, non seasonally adjusted (x 1,000,000),” May 23, 2025.

[13] Peter Spiro, “Tax exemptions for investment income: Boon or bane?,” Mowat Centre, 2017.

[14] Statistics Canada custom tabulation from Longitudinal Administrative Databank.

[15] Department of Finance, “Report on Federal Tax Expenditures: 2025,” Government of Canada, April 14, 2025.

[16] Tax Justice Network, “State of Tax Justice 2024,” November 2024.

[17] Annette Alstadsæter et al., “Global Tax Evasion Report 2024,” EU Tax Observatory, October 2023.

[18] David Coletto, “Canadians think their tax system is unfair and support new revenue tools that bring down the deficit and reduce inequality now,” Abacus Data, August 4, 2021.

[19] Diarra Sourang and Varun Srivatsan, “Estimating the Return of Additional Federal Spending on Business Tax Compliance,” Office of the Parliamentary Budget Officer, October 8, 2020.

[20]Mark Blumberg, “Blumbergs’ Snapshot of the Canadian Charity Sector 2023,” Canadian Charity Law, April 2025.

[21] James Rajotte, “Tax incentives for charitable giving in Canada,” House of Commons Standing Committee on Finance, February 2013.

[22] Julia Levin, “Fossil fuel funding in 2024”, Environmental Defence, 2025.

[23] Government of Canada, “Greenhouse gas emissions,” March 21, 2025.

[24] Department of Finance, “Report on Federal Tax Expenditures: 2025”, Government of Canada, April 14, 2025.

[25] Liberal Party of Canada, “Canada strong: Fiscal and costing plan,” 2025, https://liberal.ca/wp-content/uploads/sites/292/2025/04/Canada_Strong_-_Fiscal_and_Costing_Plan.pdf.

[26] Martine August and Corinne St-Hilaire, “Financialization, housing rents, and affordability in Toronto,” Environment and Planning A: Economy and Space, 2025.

[27] Office of the Parliamentary Budget Officer, “Removing tax exemptions for Real Estate Investment Trusts,” April 19, 2025.

[28] Department of Finance, “Report on Federal Tax Expenditures: 2025,” Government of Canada, April 14, 2025.

[29] Peter Miller and David Keeble, “Close the loophole! The deductibility of foreign internet advertising,” 2024.

By the Alternative Federal Budget Project/AFB Working Group of the Canadian Centre for Policy Alternatives. Read the oriignal article here. Reprinted under permission of the Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 Unported license.

(0) Comments