Taxation

Thought Leaders

Stock traders beware of tax traps: The taxman cometh

For speculators in GameStop, the taxman awaits around the corner, says Vern Krishna, FCGA, FCPA, CM, QC of TaxChambers LLP

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Deducting life insurance costs: Why opportunity may be overlooked

In part two of a two-part series, why paragraph 20(1)(e.2) of the Income Tax Act may be missed, from Dale Barrett and Simon Townsend of Barrett Tax Law

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Deducting life insurance costs: Paragraph 20(1)(e.2) of Income Tax Act explained

In part one of a two-part series, Dale Barrett and Simon Townsend of Barrett Tax Law on the cost of life insurance as a deductible expense

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

February 2021 Tax Court update on getting back to business — top ten takeaways

Stevan Novoselac and John Sorensen of Gowling WLG review the February 9 update from the Tax Court of Canada

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Tax preparers and professionals: Here’s what you need to know for the 2021 tax-filing season

Canada Revenue Agency on planning ahead, what’s new for upcoming tax season

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Canadian tax laws: A review of 2020 and a look ahead to 2021

A comprehensive review of Canadian tax developments in 2020 and outlook for 2021 from experts at Davies Ward Phillips & Vineberg LLP in Montreal and Toronto

- COMMENTS 13

- LIKES 149

- VIEWS 160

Business

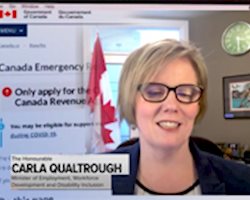

Liberals do 180 on gross blunder over CERB eligibility of self-employed

Qualtrough, Lebouthillierand Trudeau also announce one-year grace period for pandemic relief tax debt

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Canadian criminal tax evasion sentencing

A Brampton business owner was one of the few taxpayers to be sentenced in 2020

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

TFSA penalty relief: A Canadian tax lawyer's guidance

The CRA acted unreasonably in a recent TFSA overcontribution case

- COMMENTS 13

- LIKES 149

- VIEWS 160

Business

Corporation tax: ‘race to bottom’ may be ending after 40 years — here’s why it never made sense

The Canadian corporate tax rate follows decades-long global pattern of reduction

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

CRA moves forward with international audits despite continued backlog

Despite the current pandemic, Canada continues to combat international tax evasion, reports Elizabeth Egberts and Laurie Goldbach of BLG

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

A brief history on the unpleasant subject of taxes

The story of income tax is rooted in war, explains Vern Krishna, FCGA, FCPA, CM, QC of TaxChambers LLP in Toronto

- COMMENTS 13

- LIKES 149

- VIEWS 160