Crackdown: Part III

Third of a five-part series on Canada Revenue Agency proposed changes to Voluntary Disclosures Program focuses on changes to the payment schedule

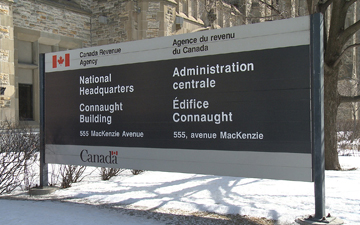

OTTAWA – The Canada Revenue Agency has proposed changes to its Voluntary Disclosures Program (VDP) that would narrow eligibility and impose additional conditions on taxpayers applying to use it. While some critics of the system applaud the move, tax professionals who deal with the program, in all its complexity, are critical of some of the proposed changes.

One such contentious proposal is the payment schedule.

The CRA’s Draft Information Circular IC00-1R6, issued for discussion purposes during the consultation period and containing references to the proposed changes to the VDP, states “If a VDP application is accepted by the CRA, taxpayers will have to pay the taxes owing, plus interest in part or in full.

"However, taxpayers would be eligible for relief from prosecution and, in some cases, from penalties that they would otherwise be subject to under the legislation.”

The circular also notes: “The taxpayer must include payment of the estimated tax owing with their VDP application. When the taxpayer does not have the ability to make payment of the estimated tax owing, a payment arrangement supported by adequate security may be considered in extraordinary circumstances with approval from CRA Collections officials.

"In these circumstances, the taxpayer must make full disclosure and provide evidence of income, expenses, assets, and liabilities supporting the inability to make payment in full.”

Canadian Accountant blogger David Rotfleisch, the owner and senior lawyer with Rotfleisch & Samulovitch Professional Corporation in Toronto, dislikes the proposal to have taxpayers pay their estimated tax up front if they haven’t filed a return for multiple years.

For example, “nobody has saved 15 years' worth of taxes plus interest. There’s no ability for them to make the payments. Often in those scenarios, they have to go bankrupt,” he complains.

Hugh Neilson, FCPA, FCA, acknowledges that the CRA is open to a possible payment arrangement if payments can’t be made all at once. Neilson is the director of taxation services for KRP Group, an accounting firm in Edmonton, and a member of the Video Tax News Board of Editors.

“But they’re going to expect a lot of disclosure to back up that you can’t make the full payment initially," he says.

"I’m hopeful that that isn’t going to backfire on them, because I could certainly see anyone who’s opposed to the changes suggesting ‘does this mean that if you’re wealthy you can buy your way out of your penalties?’” Neilson adds, contrasting their situation with taxpayers who cannot afford to pay up front, and therefore might not qualify for relief under the proposed changes to the VDP program.

“So I hope they’re going to be reasonable in their administration,” he concludes.

(0) Comments