Standards

Profession

Sunday News Roundup 22.06.19: CSSB, Supreme Court tax dissent, vax policies and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Most companies buying renewable energy certificates aren’t actually reducing emissions

Accounting sustainability standards must change say academics

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 22.06.05: Global accounting seismic changes, CPA reports, M&A and more

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Canada faces huge physical costs from climate change, making net zero a great investment

Tackling climate change more than pays for itself say new finance study

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 22.05.22: Big Four audit split, accounting standards setter goes global, and more

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

CPAB: No gap in Canadian audit watchdog’s fraud thematic review

Canadian Public Accountability Board publishes recommendations for auditors amidst global scrutiny of fraud detection failures

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Is Canada’s audit watchdog ready to bare its teeth?

The Canadian Public Accountability Board says it's planning changes to its disclosure practices amidst media scrutiny and changing best practices

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Why Canadian accountants are needed in human capital reporting

Nick Shepherd explains why a recent corporate case shows the financial cost of ignoring HR intangible assets

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Everyone should have a say on the future of green accounting

Canada may adopt international sustainability reporting rules that focus on investors, not the public, warn three Canadian accounting professors

- COMMENTS 13

- LIKES 149

- VIEWS 160

Business

Letters: ASC at the forefront of climate change-related disclosure

Alberta Securities Commission Chair & CEO Stan Magidson responds to oilpatch lending crunch article by Robert Ascah of Parkland Institute

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Ontario Auditor General wants better communication between audit and securities watchdogs

Bonnie Lysyk and Carol Paradine comment on the Auditor General's report into the structural relationship between the Ontario Securities Commission and the Canadian Public Accountability Board

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Canadian accountants thrilled with awarding of new ISSB disclosure standards hub

Montreal one of three global hubs for new accounting body based in Frankfurt

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Contesting a will in Ontario: Canadian tax lawyer guide

Provincial legislations are carefully crafted to include provisions that infringe upon and restrict an individual's testamentary freedom, says tax lawyer and accountant David J Rotfleisch

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

The future of auditing: why plans to sharpen up the industry could actually make it worse

Unintended consequences of UK audit reforms will hurt smaller companies and non-profits

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

When companies massage the books, the environment takes a hit

It’s time the accounting profession take earnings management more seriously, says financial accounting professors at Queen’s University in Kingston.

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Budget 2021 – Tax enforcement, audits, and oral interviews

If proposed legislative amendments receive Royal Assent, the Canada Revenue Agency will have the power to compel oral interviews

- COMMENTS 13

- LIKES 149

- VIEWS 160

Management

Fill in the non-GAAP: New disclosure requirements to become mandatory in August 2021

Marie-Christine Valois and Janie Harbec of Fasken review the new National Instrument 52-112, Non-GAAP and Other Financial Measures Disclosure

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Friday News Roundup 21.06.04: Sustainability standards, Isle of Man, PwC diversity and more

Wrapping up the odds and ends in this week’s Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Preparing for the new quality management standards: CSQM 1 system evaluation and monitoring

Part four of a four-part series from Kirsten S. Albo of ASK KSA Consulting Inc.

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Preparing for the new quality management standards: CSQM 1 risk responses

In part three of a four-part series, Kirsten S. Albo of ASK KSA Consulting Inc. explores the design and implementation of risk responses

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Preparing for the new quality management standards: CSQM 1 quality objectives and quality risks

In part two of a four-part series, Kirsten S. Albo of ASK KSA Consulting looks at CSQM 1 and its quality management process for all firms, regardless of size

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Preparing for the new quality management standards: An overview for Canadian practitioners

Kirsten S. Albo of ASK KSA Consulting Inc. kicks off a four-part series on CSQM 1

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Audit inconsistency remains a concern says Canada’s audit quality watchdog

Pandemic year delayed some inspections as CPAB worked remotely

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Sustainability rankings don’t always identify sustainable companies

An increasing numbers of investors depend on ESG information from third parties for their investment decisions but are the rankings meaningless?

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

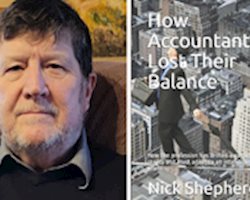

Imbalance: Accounting is not capturing the value of intangible assets

Accounting has an intangibles problem, says Nick Shepherd, author of How Accountants Lost Their Balance

- COMMENTS 13

- LIKES 149

- VIEWS 160