Profession

Partner Posts

How entrepreneurship tools are strengthening the relationship between business owners and their accountants

By recommending affordable and accessible entrepreneurship platforms like Ownr, Canadian accountants have a great opportunity to establish stronger professional partnerships with small business clients

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

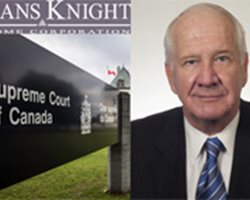

Lawyer-client confidentiality may fail to protect end-product tax documents, says FCA

The BMO Nesbitt Burns decision draws a distinction between legal advice and end-product documents says tax lawyer and accountant David J Rotfleisch

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 23.07.09: CPA EDI is woke, PwC Oz and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Transfer Pricing

Royal Bank Of Canada: A common sense approach to tax treaty interpretation

Michael Hunt and Steven Wenham of Herbert Smith Freehills LLP explain a transfer pricing ruling in the UK Supreme Court in favour of RBC and an oil exploration loan

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 23.07.02: ISSB, CSSB, sustainability and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Canadian audit watchdog CPAB sanctions third BC accounting firm this year

Smythe LLP, Manning Elliott LLP, and DMCL have all been barred by the Canadian Public Accountability Board from accepting new, high-risk clients

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

GAAR Clips Westminster’s Wings

Vern Krishna, whose work was cited in the Deans Knight decision by the Supreme Court of Canada, explains the history of the Westminster principle and GAAR

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

How to legitimately defer the worst of Canada's departure tax when becoming a non-resident and moving to another country

The departure tax can create a substantial and unforeseen tax bill for the unaware emigrating taxpayer explains tax lawyer and accountant David J. Rotfleisch

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 23.06.25: Who won round one in the Canadian accountants rift – and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Ontario, Quebec accounting bodies announce planned split from CPA Canada

Why the Collaboration Accord, which outlines the roles and finances of the governing bodies, defines the challenges facing the accounting profession

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 23.06.18: Russell Brown resigns, Carmine retires and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Alberta: Why we need to rewrite the script on corporate taxes

Corporate tax cuts did not save jobs in Alberta and wealthy people do not choose where to live based on taxes, says economics professor Junaid B. Jahangir

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 23.06.11: FCA rules on IrisTel, PwC Oz woes continue, and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Deans Knight: The return of the GAAR

The Supreme Court of Canada's decision in Deans Knight is a breath of fresh air and strikes a more appropriate balance, says Allan Lanthier

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 23.06.04: Hot economy, tax hypocrisy, and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Burden of proof for misrepresentation in tax reassessments is high — and rests with the CRA

In a recent Tax Court of Canada case, the Canada Revenue Agency's proof was flimsy, says Canadian accountant and tax lawyer David J Rotfleisch

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Taxing the wealthy to the hilt would make us all much better off

Western University professor Tom Malleson presents five reasons for levying high taxes on the very rich, from the environment to (reduced) social friction

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

US banking failures: the role of big auditors in another financial crisis

A state auditor would be better than accounting firms at policing systemically important institutions such as banks

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 23.05.28: The Deans Knight Rises, Big Four soaps, and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Special Report: Foreign accounting firms dominated Canadian mid-tiers in 2022 and the audit regulator is concerned

Audit firms based in the United States made the most net client gains in the Canadian mid-tier accounting sector, according to data compiled by Audit Analytics

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

The Revenue Rule In Tax Law

Vern Krishna of TaxChambers LLP on the history of international tax and trade law

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

GST/HST tax fraud is a ‘special operation' at the Canada Revenue Agency

It involves fraudulent refund claims, fake invoicing, and GST/HST evasion through off-the-books cash sales, explains tax lawyer and accountant David J. Rotfleisch

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Special Report: KPMG Canada beats Big Four accounting rivals in net new client gains

But Ernst and Young Canada was the real winner in new audit engagements in 2022, according to data compiled by Audit Analytics

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 23.05.14: CPAB historic disclosure, PwC Oz, and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Vancouver accounting firm Smythe LLP first Canadian audit firm to be publicly censured by regulator under new disclosure rules

Changes to enforcement disclosure rules by CPAB means more transparency from audit regulator, more public scrutiny of Canadian auditors

- COMMENTS 13

- LIKES 149

- VIEWS 160