Profession

Profession

Friday News Roundup 20.10.02: ex-MP faces tax evasion charges, Taxpayers Ombudsperson and more

Wrapping up the odds and ends in this week’s Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Friday News Roundup 20.09.25: Leafs losses, Ex-CPA jailed, tax judge named, snow washing and more

Wrapping up the odds and ends in this week’s Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Business

Canadian accountants lack economic optimism, reports CPA Canada Business Monitor

But CPAs in senior leadership positions show surprising business optimism

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Friday News Roundup 20.09.18: Tax Court complaints, audit quality, ZBB and more

Wrapping up the odds and ends in this week’s Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Friday News Roundup 20.09.11: Hotel New CFE, CRA shocks woman, and sustainable stuff

Wrapping up the odds and ends in this week’s Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Third party penalties under the Income Tax Act

Why the landmark 2015 Guindon decision by the Supreme Court of Canada matters to Canadian accountants

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

What does IES 8 mean for smaller Canadian accounting firms?

Bridget Noonan, CPA, CA on how to ensure compliance with International Education Standard 8

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Friday News Roundup 20.08.28: Chinese audit opacity, Sage practice report, ex-CPA fraud

Wrapping up the odds and ends in this week’s Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Business

Editorial: Morneau out, Freeland in as Trudeau cuts his losses

To many Canadian accountants, Morneau would be an ideal, high net worth client

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Friday News Roundup 20.08.14: KPMG, Grant Thornton, rehiring stats, and fraudster jailed

Wrapping up the odds and ends in this week’s Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Is the CRA's Northern Service Improvement Strategy enough?

Taxpayers ombudsperson says improvements still need to be made, reports Jeff Buckstein in the third of a three-part series on CRA service to northern Canada

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Is the CRA unfairly targeting residents of northern Canada?

Northern Canadian communities express frustration with frequent CRA reviews, service delivery, and residence rules

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Taxpayer’s ombudsman report flags CRA service issues in Northern Canada

The CRA disputes allegations of Northern Canada service issues, in the first of a three-part series by business reporter Jeff Buckstein

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Friday News Roundup 20.07.31: CPA Canada applauds Chamber, Morneau smoke, CFIB & more

Wrapping up the odds and ends in this week’s Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Friday News Roundup 20.07.24: Pandemic debt, WFH tax breaks, Love & Money and more

Wrapping up the odds and ends in this week’s Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Audit keeps failing — here’s why a fundamental change is needed

Recent failures of the auditing profession and Big Four accounting firms proves auditors should be responsible for detecting fraud in financial statements

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

St-Jean to replace Thomas as head of Canadian accounting profession

CPA Canada has announced the appointment of Charles-Antoine St-Jean its new president and CEO, replacing Joy Thomas

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

COVID-19: How SME accounting firms will change post-pandemic

The fifth and final story in our series on how the coronavirus crisis is accelerating change at accounting firms across Canada

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

COVID-19: Accounting firms are finding efficiencies amidst disruption

Part four in a series on how the coronavirus crisis is accelerating change at SME accounting firms across Canada

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Be careful, Canadian accountants! Your CPA Canada info was hacked

Canadian accounting profession hit by cyberattacks during COVID-19

- COMMENTS 13

- LIKES 149

- VIEWS 160

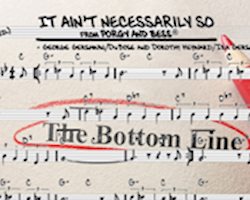

Thought Leaders

Bottom Line Profits: "It Ain't Necessarily So"*

Tax lawyer and accountant Vern Krishna looks at "the art of communicating financial information" through accounting

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Accounting profession publishes views on beneficial ownership transparency

CPA Canada and IFAC joint report on registries as AML tools

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

WFH: COVID-19 is accelerating remote work at accounting firms

Part three in a series on how the coronavirus crisis is accelerating change at accounting firms

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

A fond look back at the last Tax Court of Canada case

Two months have passed since the last court decision was published

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Tax Court of Canada to prioritize sittings for summer reopening

17-point prioritization plan detailed by Chief Justice Eugene Rossiter

- COMMENTS 13

- LIKES 149

- VIEWS 160