Profession

Profession

Which mid-sized accounting firm gained the most new clients last year?

Our annual report of 2019 SEDAR filing data crunched by Audit Analytics

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Crown bound by settlement agreement to allow losses it claimed to be a fiction

Gergely Hegedus of Dentons Canada on a recent Federal Court of Appeal decision

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

1074022 B.C. Ltd. v. Li: The need for legislative reform

A misinterpretation of section 116 of the Income Tax Act in a BC real estate case

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

KPMG Canada leads Big Four in audit client gains, losses

Our annual report of 2019 SEDAR filing data crunched by Audit Analytics

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Coronavirus tax relief: Finally some good news for accountants

Sole practitioners, small firms will benefit most from deadline extensions

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

CRA further circumscribes trust 21-year planning strategies involving non-resident beneficiaries

The CRA's stated positions will result in a chill on tax practitioners' advice to their clients, says Stephen Sweeney of Miller Thomson

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

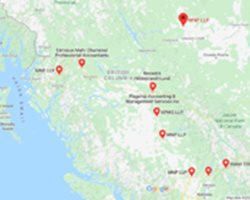

Changing of the guard in northern BC accounting

As Deloitte and PwC leave, MNP expands its footprint through mergers

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Scott v The Queen: The importance of evidence

How two brothers came under the scrutiny of the Tax Court of Canada

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Inheritance tax, wealth tax and more capital gains tax: The future of Canadian taxation?

Canadian tax policy has become a hotbed of new ideas, writes Margaret O'Sullivan

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

3 things to consider about the new CSRS 4200 accounting standard

The new CSRS 4200 is the most impactful on firms since tax reform in 2017, says Bridget Noonan. What should your firm’s first steps be?

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

CSA proposes revised non-GAAP and other financial measures rule

Following stakeholder consultation, the umbrella group of securities regulators has made substantive changes to the proposed instrument

- COMMENTS 13

- LIKES 149

- VIEWS 160

Business

Survey: Risky financial behaviours keeping Canadians in debt

Insolvency practice of accounting firm MNP probes Canadians' money mistakes

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Donor Beware: The pitfalls of participating in a donation tax shelter

The Tax Court of Canada case Abreo v. The Queen

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Canadian accountants sign global climate change statement

CPA Canada aligns with global accounting bodies to address climate change

- COMMENTS 13

- LIKES 149

- VIEWS 160

Partner Posts

How to persuade your accounting clients to adopt new technologies

Use the right approach and your clients will be scanning their own receipts, says Jennie Moore of Moore Details Inc.

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Ottawa should forget about limiting interest expense deductibility

Allan Lanthier on the OECD's proposal to limit excessive debt leveraging

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Carbon pricing may be overrated, if history is any indication

History proves radical technological change can be achieved by state intervention

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

What risk does coronavirus pose to Canadian auditors?

Securities regulator issues statement following UK, US audit watchdogs

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

The case of Muir v The Queen

Tax Court of Canada allows appeal over a section 160 assessment by the CRA

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

A sad story about Mr. X. from country Y

Canadians are deemed guilty in an unfair tax system, says Tax Lawyer Dale Barrett

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Hamad v. The Queen

Canadian tax lawyer and accountant David Rotfleisch on due diligence In director liability for taxes

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

France-US skirmish over Amazon digital tax

Shows why the century-old international tax system is broken, says Professor Ruth Mason

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Paletta et al v. the Queen, case study

Was a big Hollywood movie investment deal just make-believe?

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

20 tax audit triggers

The more risk factors a taxpayer has, the greater the odds of being audited

- COMMENTS 13

- LIKES 149

- VIEWS 160

Business

No Canadians detained in Central American tax evasion bust

Canada Revenue Agency to review files for Canadian connections

- COMMENTS 13

- LIKES 149

- VIEWS 160