The economic case for the mining industry to support carbon taxation

Rather than opposing carbon taxes, the mining sector should become a global advocate for aggressive carbon targets

Vancouver – As governments try to navigate a path to a safe climate in the 21st century, the public debate has focused on net zero, carbon taxes, electrification and renewable energy. Mining is rarely an anchor point of the discussion, even though renewable energy infrastructure and low-carbon technology require vast amounts of metals and minerals.

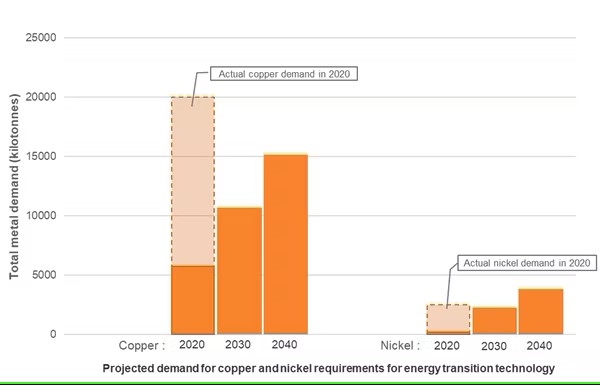

Nickel, for example, is essential for electric vehicles and battery storage. The amount of nickel required by 2040 for the energy transition alone will be equal to the total demand for nickel across all industries in 2020, according to the International Energy Agency.

There is widespread consensus among economists that carbon taxation is one of the most effective policies to reduce carbon emissions. Presently, 27 countries have enacted carbon taxation policy at the national level, yet only seven are leading mining countries, and mining companies and industry organizations oppose carbon taxes in many of these countries.

Addressing climate change requires a coalition between industry and government. The idea that the industry supplying the technology for renewable energy is also opposing the economic policy needed to curb emissions is counter productive.

Simple economic modelling proves that resisting a carbon tax is the wrong strategy for the industry. Our recent paper shows that the mining industry has an economic incentive to support a tax on carbon dioxide emissions.

Opposed to taxes

The mining industry has historically opposed taxes, especially carbon taxes. When Australia introduced a price on carbon emissions in 2011, the Minerals Council of Australia led a multi-million-dollar campaign against the carbon tax policy even though there are tax-relief provisions for emissions-intensive industries such as steel and coal.

The Australian carbon tax policy was repealed in 2014, but some mining groups do support carbon taxes. BHP Billiton Ltd. supported carbon pricing in 2017 and distanced itself from the Minerals Council of Australia.

This fractured industry standpoint on carbon pricing is also present in Canada. Some mining companies have made public commitments to carbon neutrality by 2050, yet there has been opposition from some industry groups at the provincial level.

Metals out, a little CO2 in

There are many factors throughout the mining process that contribute to carbon emissions. The commodity being mined heavily influences the amount of emissions and where the emissions are generated throughout the mining process.

For iron and steel most emissions are generated in the later stages during smelting. Mining copper ore, on the other hand, generates most of its emissions in the earlier stages during the crushing, grinding and hauling of ore.

One way to look at the impacts of carbon taxation in mining is to compare the commodity’s carbon footprint to its economic value. For example, the average carbon footprint of copper is 3.83 tonnes of carbon dioxide per tonne of copper.

So, for each tonne of carbon dioxide emitted, 261 kilograms of copper worth US$1,700, using 2019 copper prices, are produced. This is a relatively high value. The same cannot be said for other industries, like animal agriculture, where a tonne of carbon emissions corresponds to about US$125 of wholesale beef (using equivalent 2019 pricing).

How would a carbon tax affect mining?

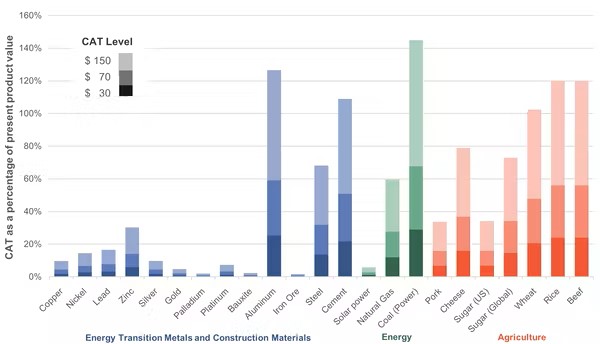

The basics of a carbon tax are that more carbon-intensive industries will be taxed more. Our study tested three levels of carbon taxation: US$30, US$70 and US$150 per tonne of carbon dioxide, and compared them against commodity prices in 2019. These levels closely follow the Pan-Canadian approach to carbon pollution pricing, which are currently set to $50 per tonne and increase $15 per year to $170 in 2030.

We modelled the impact of a carbon tax on a range of commodities. Our model included all Scope 1 and Scope 2 emissions — direct emissions from the source and indirect emissions associated with heating, cooling or electricity. The production of some commodities is more carbon-intense than others, which affects the impact of the carbon price.

In some cases, the carbon tax can be greater than the product’s value. When the price of carbon is US$150, coal is taxed at 144 per cent of its value. Copper, on the other hand, is taxed at 10 per cent of its value.

Two metals are outliers to the industry: aluminum and steel. The mining of the raw materials are not carbon intensive. Bauxite and iron ore generate 0.005 and 0.02 tonnes of carbon dioxide per tonne of product respectively, but smelting these ores into metals emits more carbon in production.

Mining for carbon taxes

Outside of aluminum refining and steel mills, the mining industry will perform better with a carbon tax than it would without one. This is because the carbon tax would increase the price of fossil fuels relative to renewable energy and the materials required for renewable energy technology.

For example, the costs of coal used for energy production will more than double, making electricity from coal increasingly uncompetitive. The rising demand for solar and wind power will drive further increases in the consumption of base metals for wind turbines and solar panels.

If implemented on a global scale, a carbon tax would not change the underlying cost of the base metal business, but it does have vast financial benefits for the mining sector. These benefits come from the increased demand for metals from the energy transition, paired with a relatively lighter percentage of global carbon taxes, in comparison to other industries.

Rather than opposing carbon taxes, the mining sector should become a global advocate for aggressive carbon targets, the harmonization of international carbon taxes and pursue further reductions to emissions such as the electrification of fleets or carbon offsets.

Benjamin Cox is a PhD student of mining engineering at the University of British Columbia; Sally Innis is a PhD candidate in mining engineering at the University of British Columbia; Nadja Kunz is the Canada Research Chair and an assistant professor of mining at the University of British Columbia; and John Steen is the EY Distinguished Scholar in Global Mining Futures at the University of British Columbia.

Top image by Dominik Vanyi on Unsplash. This article was originally published on The Conversation Canada.

(0) Comments